Navy Working Capital Fund

Fiscal Year 2000

NAV Y WO R K I NG CA P T I A L FU N D

Table of Conte n t s

Table of Contents

Overview

1

Principal Statements

27

Notes to the Principal Statements

35

Supporting Consolidating/Combining Statements

77

Required Supplementary Information

95

Other Accompanying Information

107

Audit Opinion

109

NAV Y WO R K I NG CA P T I A L FU N D

Overview

Department of the Navy

Navy Working Capital Fund

Background

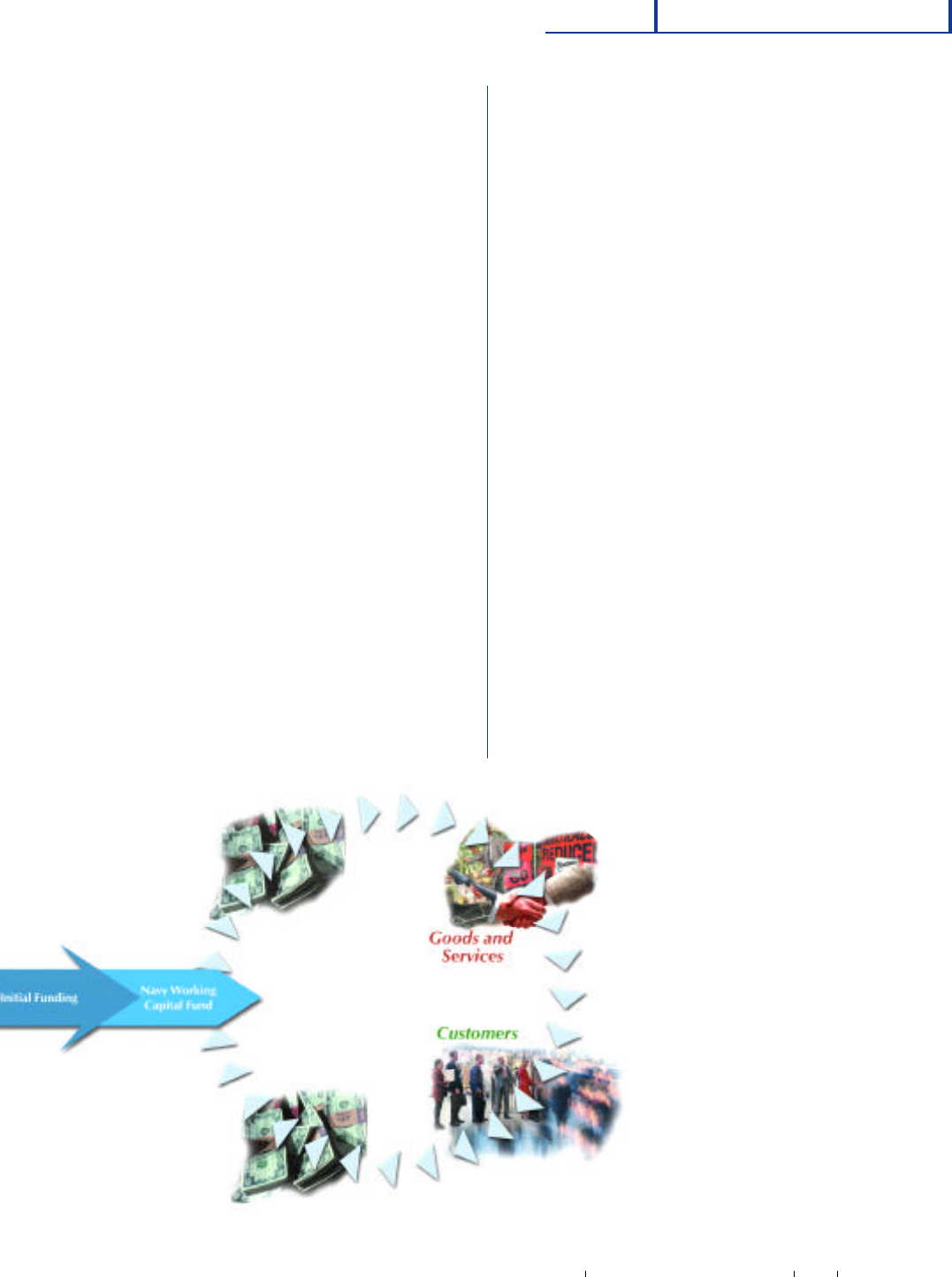

The Navy Working Capital Fund (NWCF) is

comprised of activities, or business areas, that

provide goods and/or services that support the

missions and objectives of the Department of

the Navy (DON), and the Department of

Defense (DoD), and operate under business

financial management principles in a buyer-and-

seller approach. To be included in a Working

Capital Fund, a business activity must meet four

criteria:

The business operations of the activity

must produce identifiable outputs,

either goods or services, that serve

Military Department or Defense

Agency requirements.

The activity must have an accounting

system capable of collecting the costs

of production and assigning these

costs to the appropriate outputs.

The activity must be able to clearly

identify its customers and to align its

resources to best meet the

requirements of these customers.

The activity must have evaluated the

advantages and disadvantages of the

buyer-seller relationship; and assessed

the customer’s ability to influence the

activity’s cost by changing demand.

1.

2.

3.

4.

1

NAV Y WO R K I NG CA P T I A L FU N D

O ve rv i e w

Navy Working Capital Fund

History of the Navy Working Capital Fund

The Navy Working Capital Fund (NWCF) is

one of four Defense Working Capital Funds

(DWCFs):

• Army Working Capital Fund

• Navy Working Capital Fund

• Air Force Working Capital Fund

• Defense-wide Working Capital Fund

The basic concept of working capital funds

evolved from a dual categorization of funds: Stock

Funds and Industrial Funds. Stock Funds, used by

the Navy since the 1870’s, dealt with procuring

materials in volume from commercial sources and

holding an inventory for subsequent sale to

customers. Industrial Funds, used by the Navy

since the 1940’s, provided industrial and

commercial goods and services such as depot

maintenance, transportation, and research and

development. The National Security Act

Amendments of 1949 authorized the Secretary of

Defense to establish revolving funds as the

business model for the operation of these funds.

In FY 1992, the Department of Defense (DoD)

consolidated the multiple stock and industrial

funds throughout the service into one Defense

Business Operations Fund (DBOF), centrally

managed by the Office of the Under Secretary of

Defense (Comptroller) (USD(C)). The primary

goal of the DBOF was to focus the attention of

DoD management on the total costs of certain

common DoD business operations.

In FY 1995, the central cash management

function assumed by USD(C) was returned to the

DoD component level providing activity group

managers control of and accountability for their

operations. In FY 1997, the DBOF was

reorganized into the current DWCF structure to

clearly establish the components’ overall

responsibility for managing and operating their

respective working capital functions.

NAV Y WO R K I NG CA P T I A L FU N D

2

FY 2000

Overview

Unique Features of the

NWCF

Organizational Structure

The Principal Statements included in this

annual financial report present the

consolidated financial position and results of

operations for all the activities included in the

NWCF. To provide the reader with a more

complete understanding of the NWCF, these

activities are segregated by their respective

business areas in the supporting

consolidating/combining financial statements.

These activity groups include:

Depot Maintenance: The NWCF activities

include the Depot Maintenance function for

the Shipyards, Aviation, and the Marine Corps.

Each Depot Maintenance function is presented

separately in the supporting consolidating/

combining financial statements.

Transportation: The Military Sealift Command

provides the transportation services required

to maintain the Navy’s global position and

infrastructure. On the supporting

consolidating/combining statements, the

financial position and the results of the

operations of the Military Sealift Command

are shown in the Transportation activity group.

Base Support: The daily operations of the

today’s Navy require a solid infrastructure

supporting its global presence. The Naval

Facilities Engineering Service Center and the

Public Works Centers support the daily

operations of the Navy, and are included in the

Base Support activity group in the supporting

consolidating/combining financial statements.

Information Services: In the twenty-first

century, the electronic infrastructure of the

Navy is supported in the NWCF by the Navy,

Fleet Material Support Office, the Naval

Computer and Telecommunications Centers,

and the Naval Reserve Information Systems

Office. The financial position and the

operating results of these activities are grouped

together and presented as the Information

Services activity group in the supporting

consolidating/combining financial statements.

Research and Development: The development

of the tools and technology of the Navy of

tomorrow is supported in the Research and

Development activity group of the NWCF.

The Naval Surface Warfare Center, the Naval

Air Warfare Systems Center, the Naval

Undersea Warfare Center, the Naval Research

Laboratory, and the Space and Naval Warfare

Centers are included in the Research and

Development activity group in the supporting

consolidating/combining financial statements.

Supply Management: The challenge of

providing our global Naval forces with high-

quality goods and supplies is met by the Supply

Management activities. Supply Management -

Navy, and Supply Management - Marine Corps

are the two activities combined in the Supply

Management activity group presented in the

supporting consolidating/combining financial

statements.

In addition to the activity groups reporting

the FY 2000 cost of operations, the NWCF

financial statements also reflect the residual

financial activity associated with the Ordnance

Activity Group, which was transferred to the

Department of the Navy General Fund and

the Department of the Army Working Capital

Fund effective 1 October 1999. The

Combining/Consolidating Statements also

3

NAV Y WO R K I NG CA P T I A L FU N D

O ve rv i e w

Navy Working Capital Fund

show the Component level reporting activity.

The Component Level is not an operational

activity unit or group, but is rather an

administrative reporting mechanism used to

reflect transactions that are not readily

identifiable with a single activity or activity

group. Historically, the Component Level

reflects transactions related to disbursements,

collections, and department-level adjustments

for certain eliminating entries.

Sources of Funding

The funding of the NWCF is based on a

revolving-fund concept of operations, under

which the NWCF activities received their initial

working capital through an appropriation or

through a transfer of resources from existing

appropriations of funds and used those

resources to finance the initial cost of products

and services. Financial resources to replenish

the initial working capital and to permit

continuing operations are generated by the

a c c e ptance of customer orders.

Customer Orders

Customer orders accepted by the NWCF

activities must be either obligations of a

federal government activity or cash advances

from non-federal government customers.

The acceptance of a customer order creates

a quasi-contractual relationship between the

NWCF activity and its customer.

In FY 2000, the customer orders placed

with the NWCF activities included those

initiated by:

1. DON Commands and Activities

2. Other Military Departments

3. Other DoD agencies

4. Non-DoD federal government agencies

5. Others not officially representing the

federal government.

The customers of each NWCF activity are

responsible for budgeting for and budgetary

control of the cost of end products and

services ordered from the NWCF activity. The

customer cannot use its appropriated funds to

do indirectly (through the NWCF activity)

what it is not permitted to do directly.

The availability of an appropriation

cannot be expanded or

otherwise changed by transfer

to the NWCF. The customer

bears the primary

responsibility for the

determination of the

applicability of its

appropriated funds in

the orders placed with

the NWCF activity.

Stabilized Rates

One of the features of the

NWCF that allows its customers to

accurately plan and budget their

NAV Y WO R K I NG CA P T I A L FU N D

4

FY 2000

Overview

appropriated funds for NWCF support

requirements is the rate stabilization policy

adopted by the NWCF. For each budget year,

the NWCF establishes customer rates on an

end product basis whenever feasible. These

rates are set at levels estimated to recover the

cost of products or services to be provided.

This “stabilized rate” policy protects

appropriated fund customers from unforeseen

cost changes, and also minimizes fluctuations

in planned NWCF work levels, permitting a

more effective use of NWCF resources.

In conjunction with the stabilized rate policy,

the NWCF uses a cost recovery—or break-

even—policy. With stabilized rates, gains or

losses in operations may occur as a result of

variations in program execution. To maintain

full cost recovery and thereby to break even

over the long term, NWCF activities generally

adjust their rates each year to reflect such

realized gains and losses.

For the Supply Management activity group,

customer rates are established using

commodity costs in conjunction with a cost

recovery factor that recovers such costs as

transportation and certain personnel costs.

The other NWCF activity groups customer

rates are established on the basis of unit cost

rates established based on the identified unit

of output. These unit cost rates incorporate

the recovery of costs, and prior year gains

and losses.

Budget Execution

During budget execution, activity groups

calculate the difference between the amount of

revenue collected from customer orders and

the actual cost of meeting customer demands,

and record either a positive or negative

Operating Result. The revenue collected from

customers for orders placed and the costs

incurred to fill those orders differ from the

earned revenue and the program costs and the

earned revenue appearing in the Consolidated

Statement of Net Cost included in the

accompanying financial statements. Within the

Consolidated Statement of Net Cost, the

Program Cost and Earned Revenue have been

adjusted to support intragovernmental

elimination-entry requirements.

T

he term “end product” refers to the item or service requested

by the customer (output) rather than to the processes or other

inputs required to achieve of the requested output (for example,

the product requested rather than the direct labor hours

expended in the achievement of that product).

5

NAV Y WO R K I NG CA P T I A L FU N D

O ve rv i e w

Navy Working Capital Fund

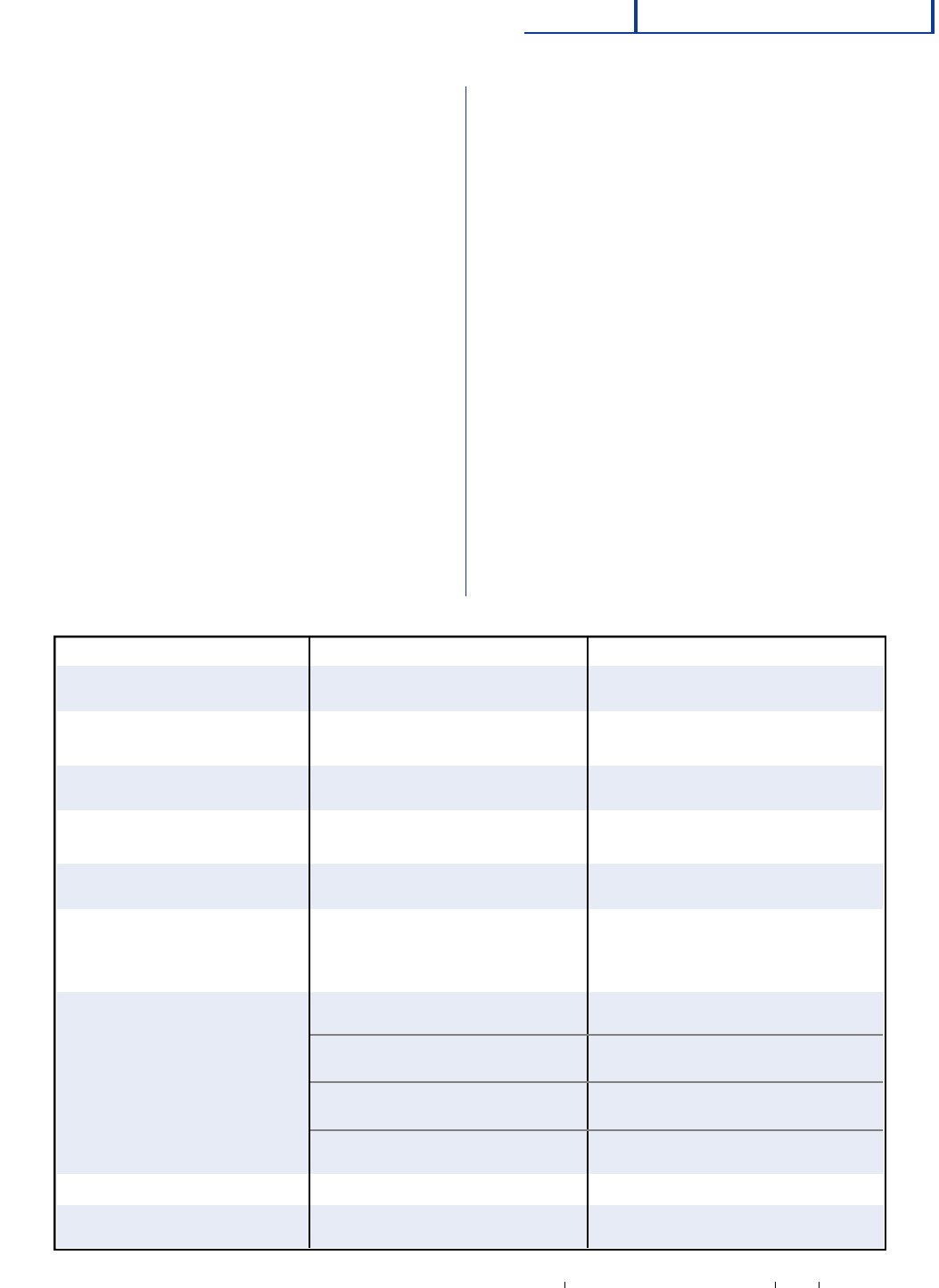

NWCF Activity Groups

The NWCF is comprised of activity groups with

a variety of missions, resources, and capabilities

to address the Navy and other customer’s

specialized needs. Two major changes have

occurred in the activity group structure since

FY 1999. The first change entailed the transfer

of the Ordnance activity group to the

Department of the Navy General Fund and the

Department of the Army Working Capital Fund,

effective 1 October 1999. The financial

information presented for the Ordnance

activity group reflects the residual accounting

data related to operations conducted prior to

September 30, 1999. The second change was

the transfer of financial accountability for the

Naval Computer and Telecommunications

Station from the Information Services activity

group to the Research and Development

activity group’s Space and Naval Warfare

Systems Center, effective 1 October 2000 (FY

2001). The organizational structure of the

NWCF for FY 2000 is illustrated below:

Depot Maintenance - Shipyards

The mission of Depot Maintenance – Shipyards

is to provide logistic support for ships and

service craft; to perform construction, overhaul,

repair, alteration, dry-docking, and outfitting

of ships and craft; to per form design,

manufacturing, refit, and restoration; and to

provide services and material to other activities

and units as required.

The Depot Maintenance-Shipyards activity

group operates three regional shipyards:

Portsmouth Naval Shipyard’s primary mission

is the overhaul, repair, modernization, and

refueling of Los Angeles Class nuclear-powered

submarines. Located in Portsmouth, NH, this is

the Navy’s most experienced shipyard in

submarine design, construction, modernization,

and maintenance. The shipyard is currently

diversifying into deep ocean submersibles and

special operations, and additionally serves as

The destroyer USS Arthur W. Radford (DD 968),

undergoing repairs at Norfolk Naval Shipyards.

Overview

NAV Y WO R K I NG CA P T I A L FU N D

6

FY 2000

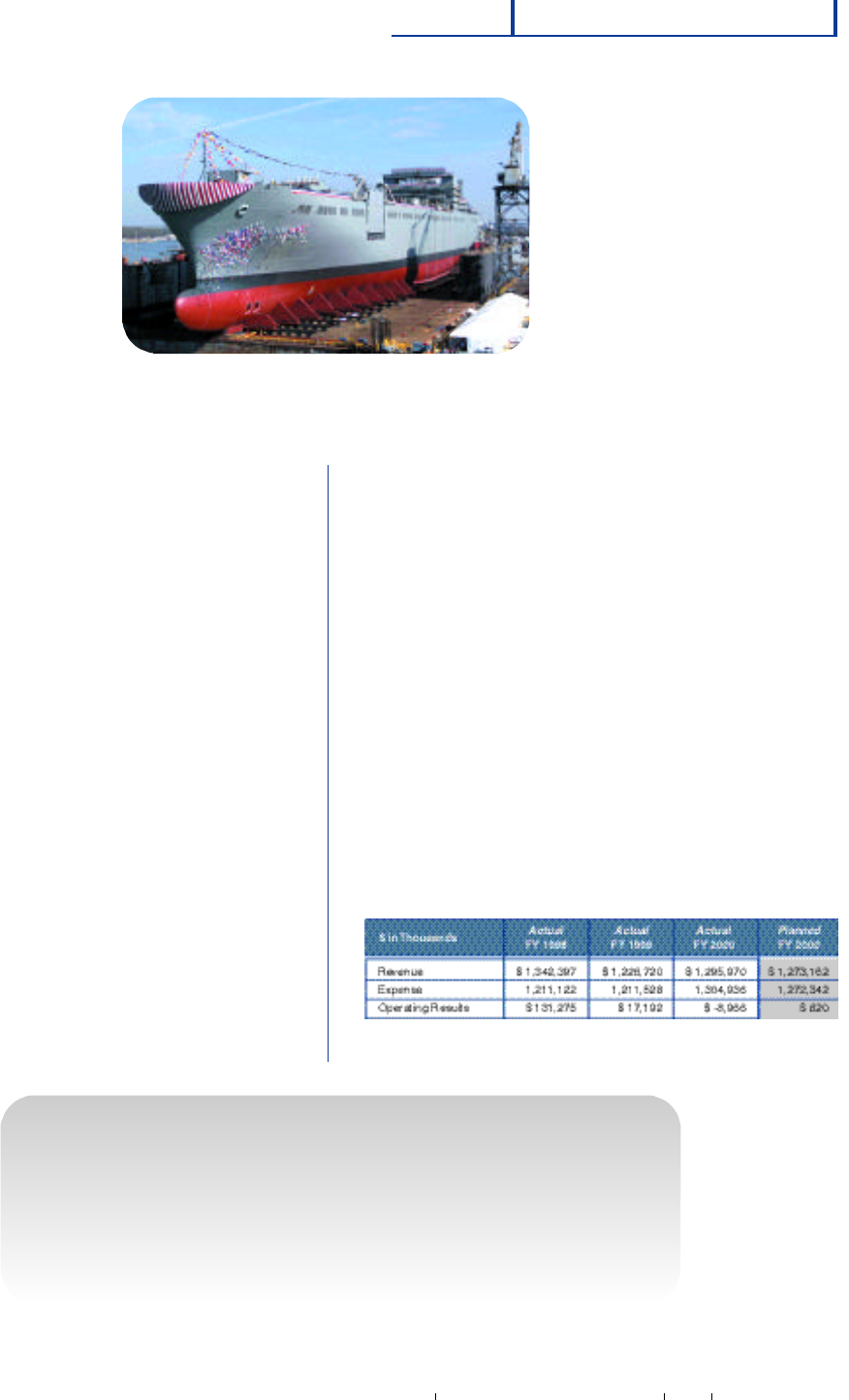

Operating Results

The three NWCF Naval Shipyards exceeded

budgeted Operating Results as a result of

increased workload and fixed price gains. This

positive Operating Results performance has

allowed the implementation of the quarterly

surcharge policy. This is the first time a DoD

Activity has implemented this policy to reduce

costs to the customer, and has resulted in

freeing $32.1 million for their customer,

CINCPACFLT, to reprogram in accordance

with its mission objectives.

Depot Maintenance - Aviation

The mission of Depot Maintenance – Aviation is

to provide responsive worldwide maintenance,

engineering, and logistics support to the Fleet

and to maintain the essential industrial

capability to support mobilization. The activity

group must repair aircraft, engines, and

components and manufacture parts and

assemblies; provide engineering services in

the development of hardware design changes;

and furnish the technical and other professional

services to resolve maintenance and

logistics problems.

The mission of Depot Maintenance - Aviation is

supported by three modern industrial facilities

commissioned by the Navy to perform in-depth

overhaul, repair, and modification of aircraft,

engines, and aeronautical components.

Although these depots share a common

mission, each location specializes in

particular aircraft, engines, components, and

support programs.

the planning yard for the Navy’s deepest diving

submarine and submersible and for other

scientific research, defense prototype testing,

and submerged rescue platforms.

Norfolk Naval Shipyard is the largest of the

Navy Shipyards.This shipyard, located in

Portsmouth, VA, operates seven dry docks and

about 400 cranes. In addition to its ship-work,

the Norfolk Naval Shipyard also serves as the

East Coast cryptographic repair depot which

repairs, modifies, overhauls, certifies and

installs cryptographic equipment, and as a

depot-level antenna repair facility and range site

that removes, restores, tests, and reinstalls

Information Delivery Devices (IDD), Automatic

Carrier Landing Systems (ACLS), and navigation

and surface/air search antennas.

Puget Sound Naval Shipyard is the Pacific

Northwest’s largest Naval shore facility and the

largest shipyard on the West Coast. Located in

Bremerton, WA, the shipyard has pioneered an

environmentally safe method of deactivating

and recycling nuclear-powered ships, making

the U.S. Navy the world’s only organization

able to design, build, operate, and recycle

nuclear-powered ships. Approximately 30

percent of the shipyard’s workload involves

the inactivation, reactor compartment disposal,

and recycling of ships.

T

he Portsmouth Shipyard celebrated its

bicentennial in FY 2000, having been

established by the Secretary of the Navy on

June 12, 1800. The Honorable Richard

Danzig, Secretary of the Navy, provided the

keynote address for this anniversary.

7

NAV Y WO R K I NG CA P T I A L FU N D

O ve rv i e w

Navy Working Capital Fund

NAVANDEPOT Cherry Point, NC: The only

facility of its kind under the management of

Marine Corps officers, this facility includes the

AV-8B Harrier, the vertical takeoff and landing

tactical attack jet flown by the Marines, among

its specialties.

NAVANDEPOT Jacksonville, FL: A number of

carrier battle group aircraft, such as the F-14

Tomcat, the F/A-18 Hornet, and the EA-6B

Prowler, are kept in the air through the

dedication of the Jacksonville facility.

NAVANDEPOT North Island, CA: In addition

to supporting the F/A-18 Hornet, this facility in

San Diego supports the E-2 Hawkeye, the C-2

Greyhound, and the S-3 Viking, helping the

Navy to keep technical aircraft superiority.

Operating Results

There are several operational and financial

system sources for the variance between the

actual and planned Operating Results for

Depot Maintenance - Aviation. The planned

result anticipated full implementation by

September 2000 of a new completion

methodology for revenue recognition, but

successful transition to this methodology was

not achieved by all of the programs engaged in

the changeover. Other factors contributing to

this variance include the component program,

where physically completed units (G-condition

units) were not billed; funding shortfalls; and

delays in aircraft, engine, and other support

and manufacturing programs.

Marine Corps Depot Maintenance

Activity Group

The mission of the Marine Corps Depot

Maintenance Activity Group (DMAG) is to

provide quality, responsive maintenance and

maintenance-related products and services to

the Fleet Marine Force (FMF) and other

customers while maintaining the core industrial

base necessary to support mobilization and

surge requirements.

The Marine Corps DMAG consists of two

Multicommodity Maintenance Centers, located

in Albany, GA and Barstow, CA. The two

centers return unserviceable equipment to

serviceable condition, perform maintenance up

to the depot repair level, and overhaul, rebuild,

and modify all types of ground combat and

combat support equipment used by the

Marine Corps and other DoD services.

The Marine Corps DMAG performs work for all

Components of the Department of Defense.

The primary customer of the group is the

Marine Corps, whose requirements originate

from the Life Cycle Management Center and

the Fleet Support Division, Marine Corps Logist i c s

Bases in Albany, GA and Barstow, CA.

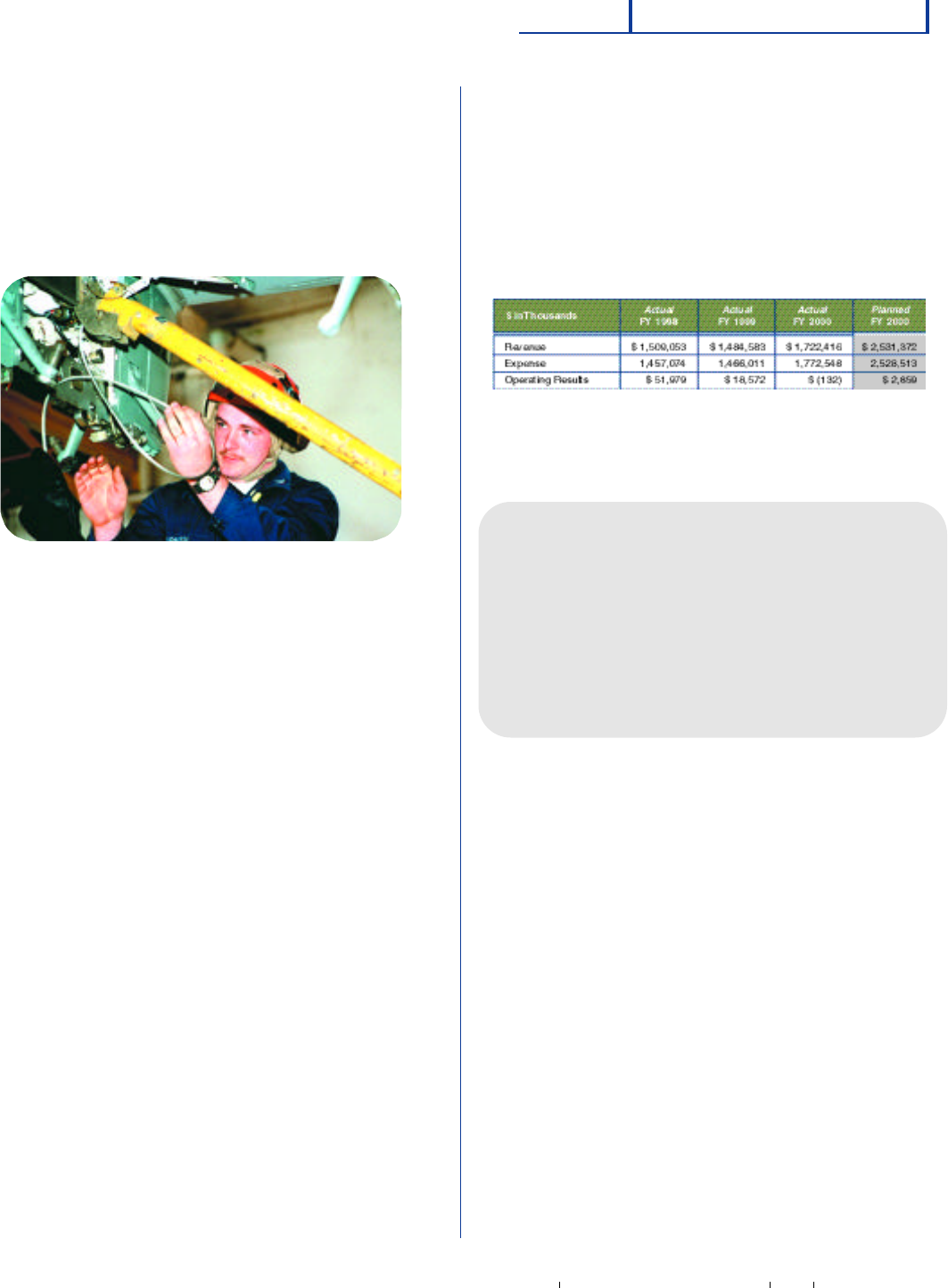

An Aviation Electronics Technician positions the cable that will hoist

a MK62 mine onto the P-3’s bomb rack at the Naval Air Station,

Jacksonville.

Overview

Transportation

Military Sealift Command

The mission of the Military Sealift Command is

to provide efficient sea transportation, combat-

ready logistics forces, and reliable special mission

ships for the Department of Defense in times of

peace and war.

The Military Sealift Command (MSC) has dual

reporting responsibilities to the DON and to

the U.S. Transportation Command

(USTRANSCOM).

MSC supports three business lines:

Afloat Prepositioning Ships – Navy (APF-N)

place U.S. Marine Corps, Army, and Air Force

equipment in strategic locations around the

world, such as the Mediterranean Sea and

Persian Gulf, and are key in keeping the U.S.

military forward-deployed.

Special Mission Ships (SMS) work with

scientific and military commands to expand

knowledge of the world’s oceans, combat

drug smuggling, monitor international

compliance with strategic arms treaties, and

lay submarine cable.

Naval Fleet Auxiliary Force (NFAF) ships

support the Navy around the world, providing

everything from fuel to food to ammunition

and towing services. NFAF ships keep the

Navy’s combatants at sea, on station, and

combat-ready.

NAV Y WO R K I N G CA P T I A L FU N D

8

FY 2000

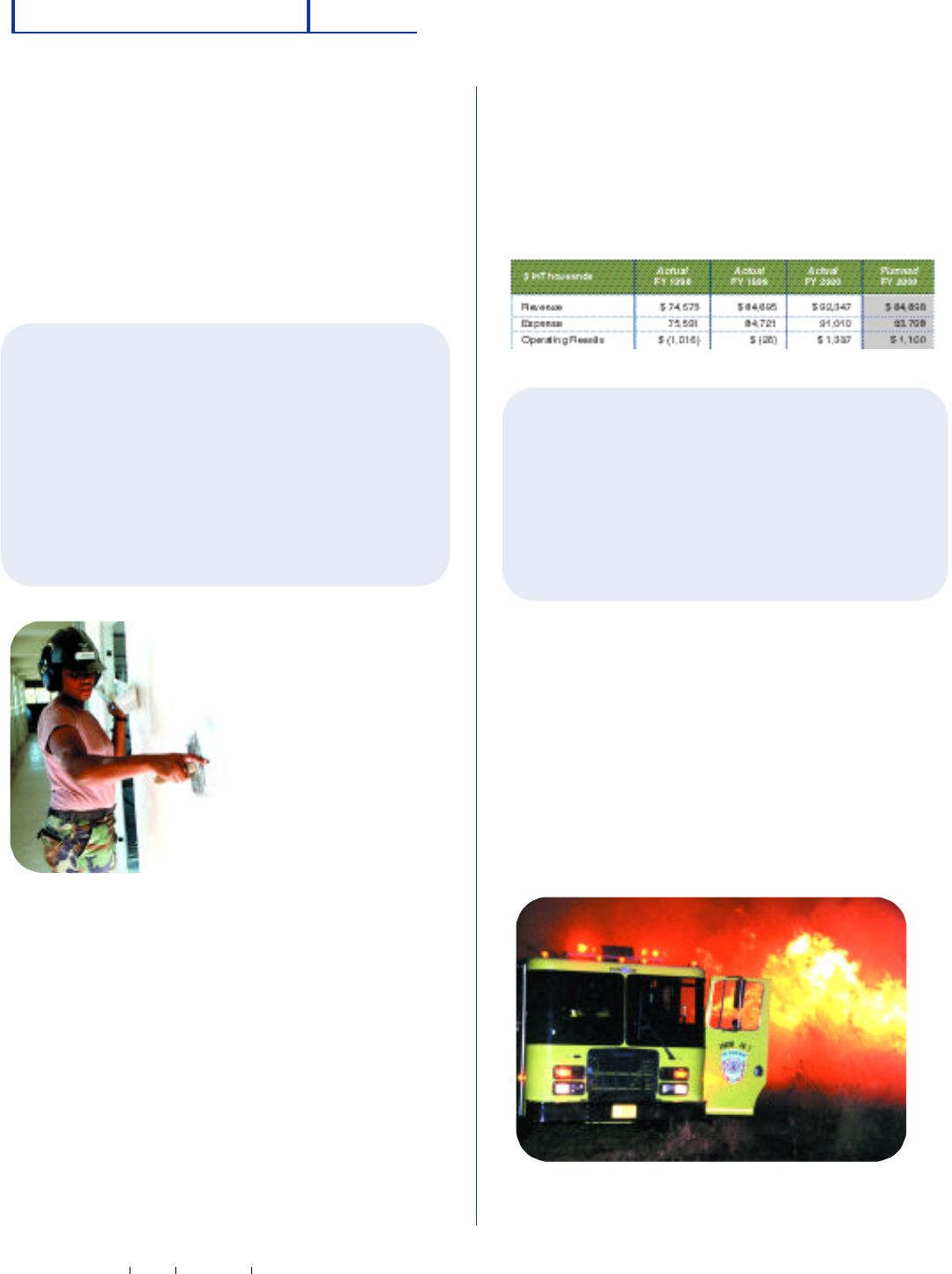

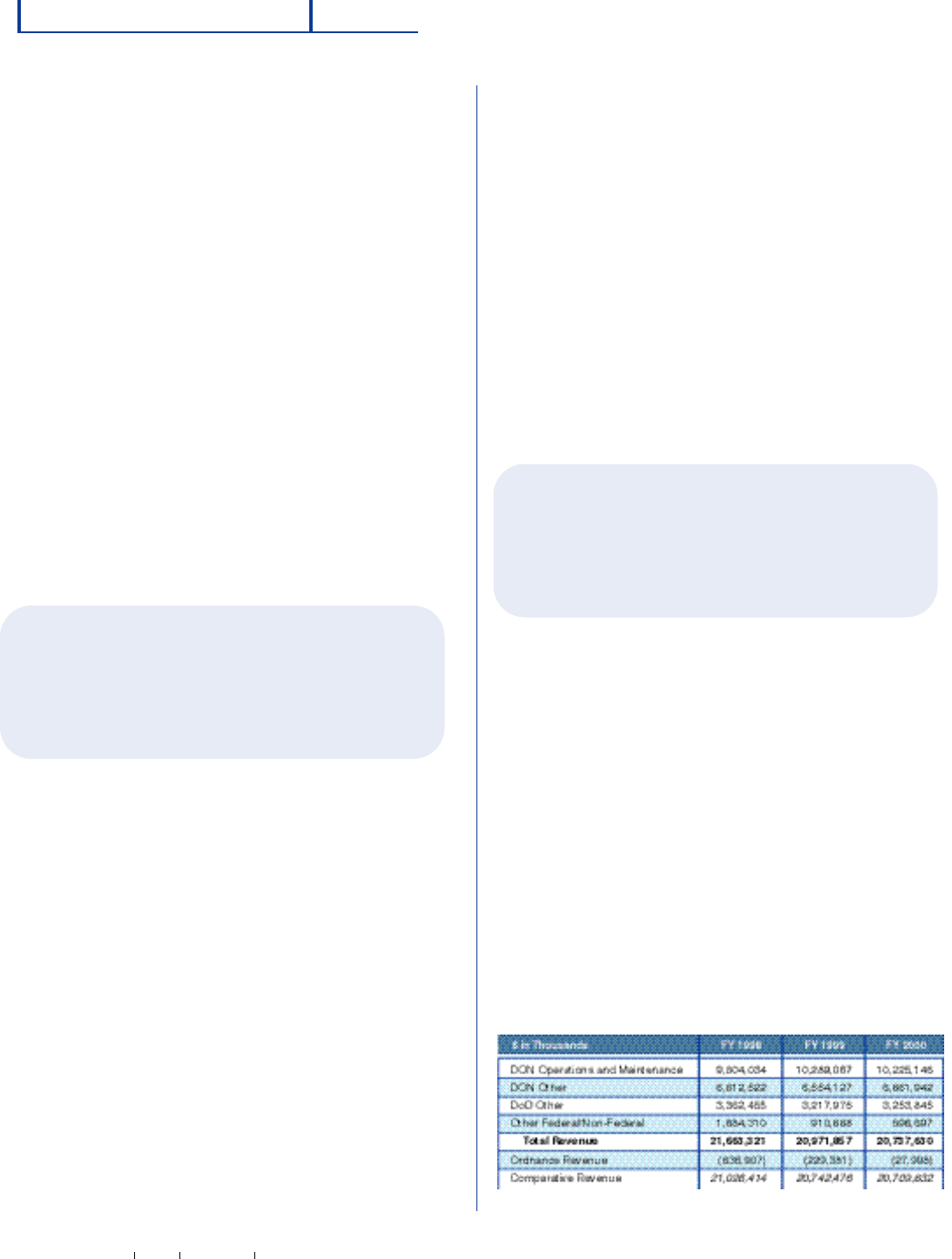

Operating Results

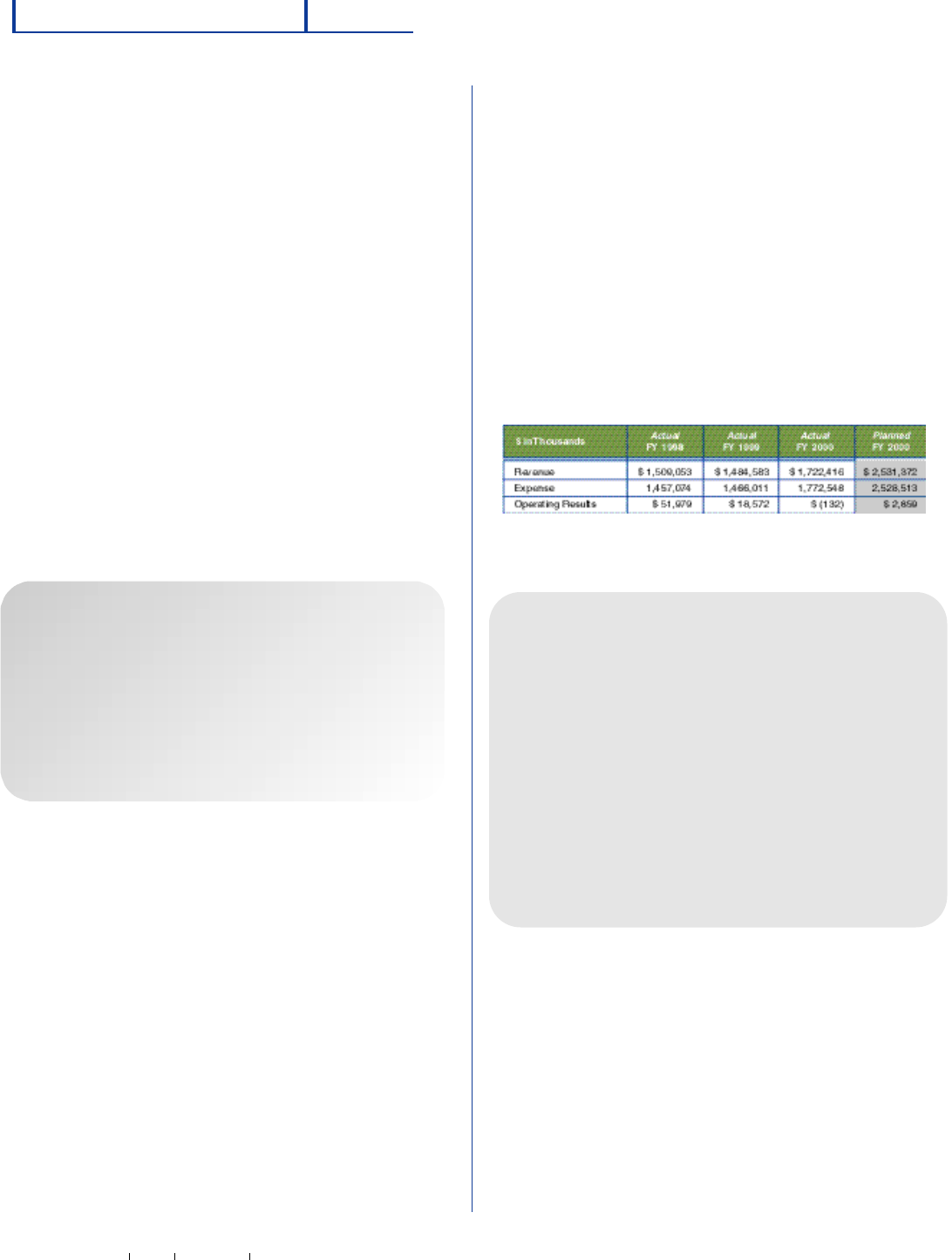

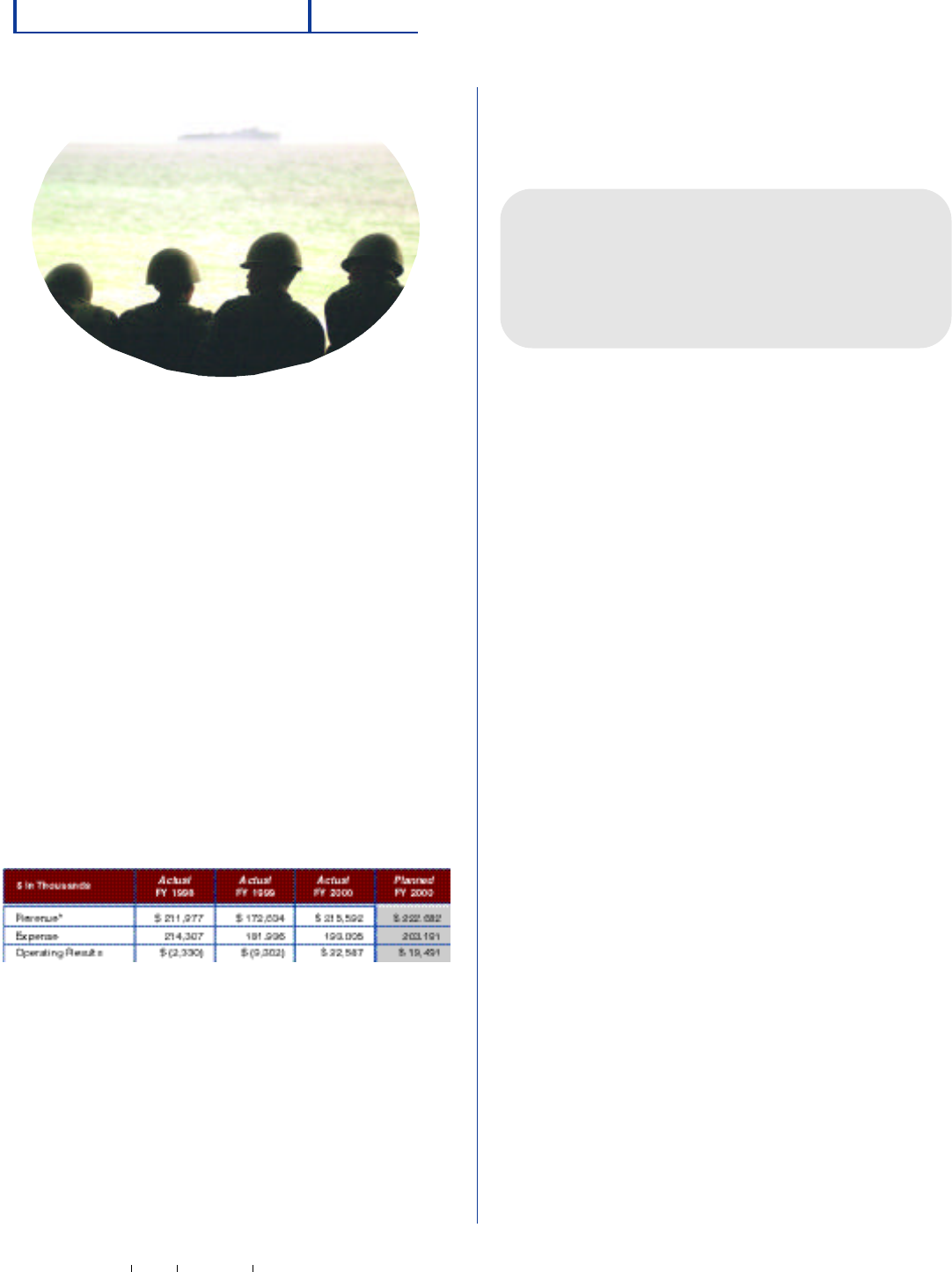

Operating Results increased $31.9 million in

FY 2000, as compared to the actual Operating

Results recorded in FY 1999. Although

revenue was $7.1 million lower than plan;

Operating Results exceeded plan by $3.1

million, or 15.9%. The reduction of costs

resulted from intense management efforts to

control costs within the Maintenance Centers

and the stabilized rates established to recover

operating expenses and to offset prior years

unbudgeted operating losses.

A group of Filipino Marines wait for an armored assault vehicles

to come ashore from USS Mount Vernon (LSD 39). Filipinos

and U.S. Marines will work together to defend and assault the

beach in Ternate, Philippines.

9

NAV Y WO R K I NG CA P T I A L FU N D

O ve rv i e w

Navy Working Capital Fund

All MSC ships are crewed

by civil service or contract

merchant mariners, freeing

active duty sailors for more

traditional war-fighting

assignments.

The heavy lift ship MV Blue

Marlin, under contract with

MSC, transported the

damaged Navy destroyer

USS Cole from the Gulf of

Aden to the United States

for repairs. (The 505-foot USS Cole survived a

terrorist attack that left a

40-by-40-foot hole in her port side and 17 U.S.

Sailor casualties.)

The organization of MSC is geographically

diverse, to support the needs

of its widespread customer base:

MSC Headquarters is located in Washington,

D.C., with the mission to administer and direct

MSC resources to meet the needs of its global

customer base.

MSC Europe is located in Naples, Italy, serving

customers based in the European theater.

MSC Far East is located in Yokohama, Japan,

serving MSC customers based in Japan and

along the Pacific Rim.

MSC Pacific is located in

San Diego, CA, providing

support throughout

Southern California and, in

conjunction with MSC

Pacific in Alameda, CA, to

customers in Northern

California.

MSC Atlantic is situated in

Camp Pendleton, VA,

sponsoring representatives

in Puerto Rico and New Orleans in support of

the MSC customer base in the Gulf of Mexico,

the Caribbean, and Puerto Rico.

MSC Central, established in FY 2000 in

Manama, Bahrain, provides direct support to

the Navy’s Fifth Fleet Commander in theater.

Operating Results

The congressional budget reflected planned

Operating Results of $.8 million, but the actual

expenses exceeded the revenue reported for

FY 2000 by $8.9 million, resulting in Operating

Results at $9.8 million less than planned.

M

SC has saved taxpayers $30 million since the 1993

inception of its Afloat Residual Asset Management

System (ARAMS) for the allocation of ship parts. MSC received

the Hammer Award for this innovative, cost-saving program.

Military Sealift Command Cargo Ship Three Zero Four

(T-AKR 304) is of ficially christened Pililaau in honor of Medal

of Honor recipient Private First Class Herbert K. Pililaau.

Overview

NAV Y WO R K I NG CA P T I A L FU N D

10

FY 2000

NFESC also provides engineering, design,

construction, consultation, test and evaluation,

technology implementation, and management

support services.

Operating Results

Public Works Centers

The Public Works Centers provide utilities

services, facilities maintenance, family housing

services, transportation support, and

engineering services, in addition to the shore

facilities planning support required by operating

forces and other activities.

The Public Works Centers (PWCs) provide

utilities and transportation support; major

maintenance of buildings and structures,

grounds, streets, walks, and parking lots;

janitorial, refuse collection and disposal and

pest control services; and engineering and

facilities inspection functions. These products

and services are provided in-house or through

contracts awarded and administered by PWC.

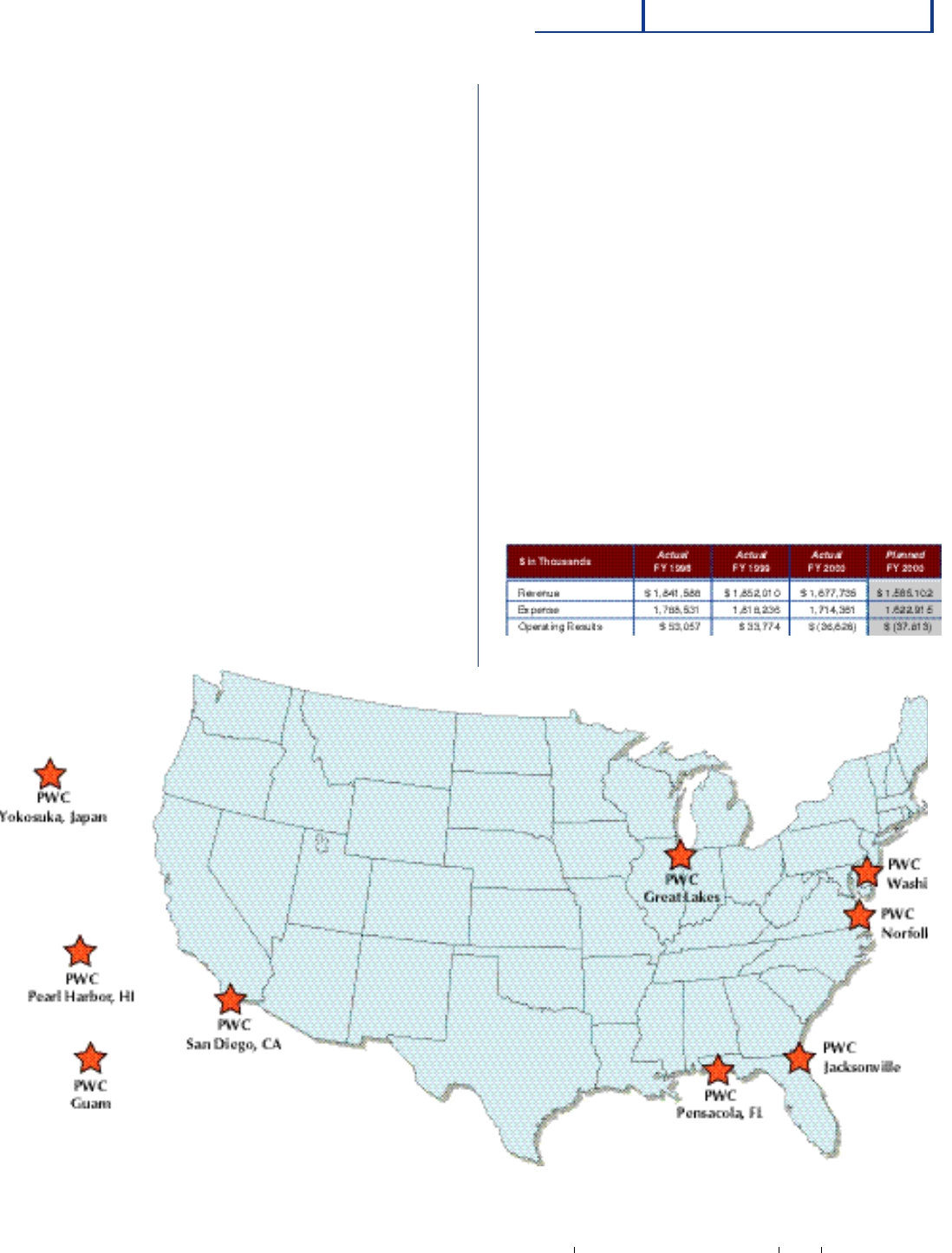

Base Support

The Naval Facilities Engineering Service Center

and the Public Works Centers are the activities

that provide the infrastructure necessary to

support the global operations of Naval forces.

In FY 2000, these activities accounted for 8.5

percent, or $1.7 billion, of total NWCF revenue.

Naval Facilities Engineering Service Center

The Naval Facilities Engineering Service Center

(NFESC) provides engineering, design,

construction, technology implementation,

and management support worldwide to shore,

ocean, and waterfront activities and to

amphibious and expeditionary operations.

The center also provides environmental,

energy, and utility services.

Located in Port

Hueneme, CA, the

Naval Facilities

Engineering Service

Center (NFESC) was

established when

the missions of six

components of the

Naval Facilities

Engineering

Command were

consolidated for

greater efficiency.

NFESC operates specialized engineering and

technology facilities, working in partnership

with its customers to deliver products and

services in the four areas of:

• Shore, Ocean, and Waterfront Facilities

• Environment

• Amphibious and Expeditionary Operations

• Energy and Utilities

A builder 3rd Class plasters a wall

inside the Bundy Barracks at NAS

Roosevelt Roads, Puerto Rico.

The Guam Fire Department battles a roaring fire, one of the 43

it battled in a single, record-breaking day.

A presidential commission in 1947

recommended that, where possible,

government industrial-type activities should

consolidate. The Navy followed this direction

in 1948 by successfully setting up its first PWC

in Norfolk, VA. Nine other PWCs, consolidating

more than 80 public works departments, were

established as follows:

- 1952 Pearl Harbor, Hawaii

- 1958 Guam

- 1963 Pensacola, Florida

- 1965 Great Lakes

- 1965 Yokosuda, Japan

- 1974 San Francisco, California

- 1992 Washington, D.C.

- 1992 Jacksonville, Florida

11

NAV Y WO R K I N G CA P T I A L FU N D

O ve rv i ew

Navy Working Capital Fund

On 7 April 2000, PWC Guam transferred all

operational functions to Raytheon Technical

Services Guam (RTSG), reducing its rolls as a

consequence from 732 to 105 civilian

employees. The transfer was made under the

terms of a Base Operating Services (BOS)

contract decreed as a result of an A-76/

Commercial Activities (CA) decision.

Operating Results

Revenues and expenses were both above plan

in FY 2000, producing a net operating result

$1.2 million above plan. Key contributing

factors to this variance were the increased cost

of electricity purchased at PWC San Diego

and the conversion of PWC Guam to a

BOS contract.

Overview

NAV Y WO R K I NG CA P T I A L FU N D

12

FY 2000

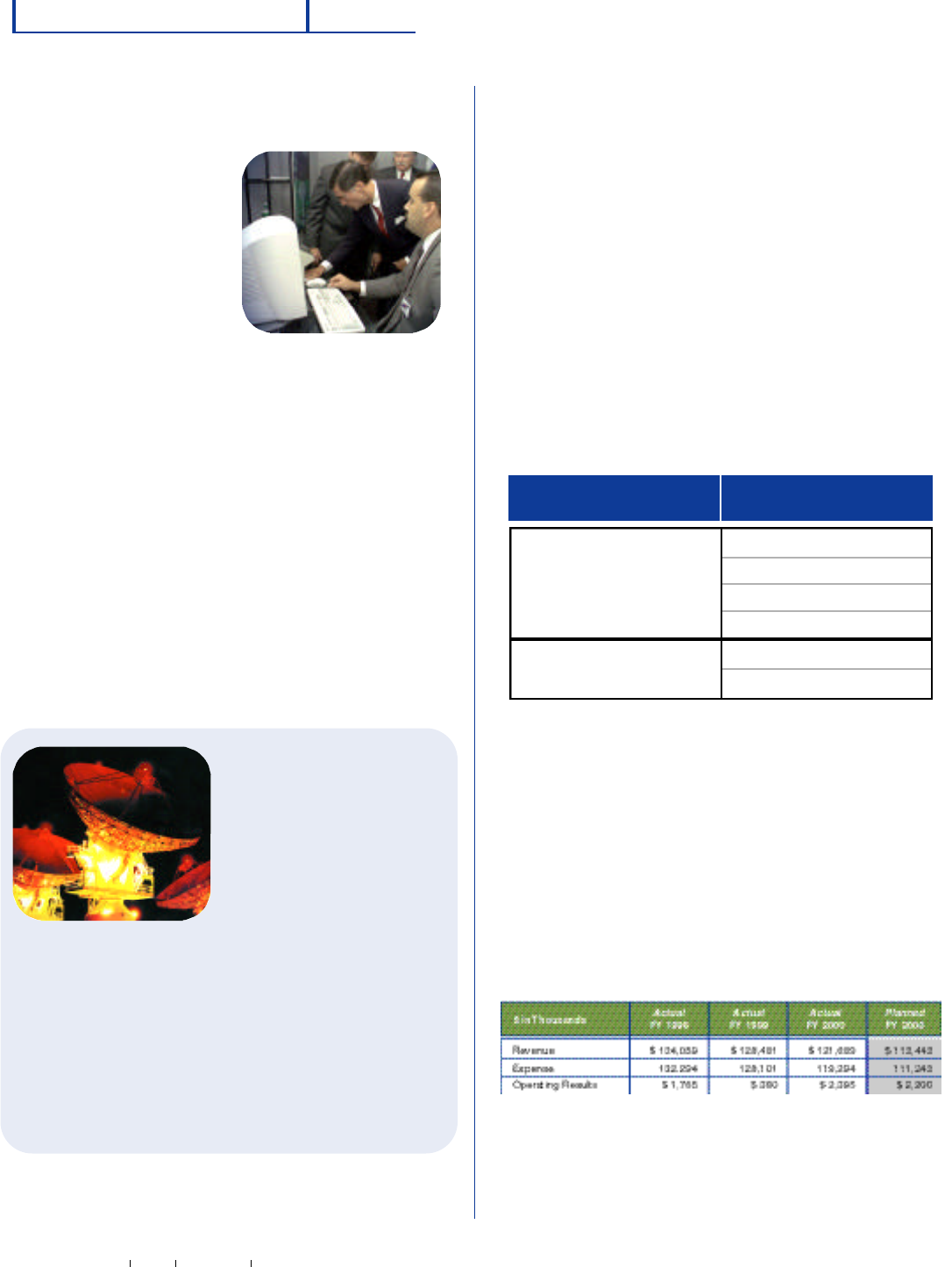

Information Services

The Information

Services activity group

includes the Naval

Computer and

Telecommunication

Centers (NCTC); the

Navy, Fleet Material

Support Office

(FMSO); and the Naval

Reserve Information

Systems Office

(NIRSO). The

comparative size of these organizations and

their respective contributions to the financial

statement presentations can be illustrated by

their relative revenue contributions: in FY 2000,

NCTC reported revenue of $121 million;

FMSO, $75.9 million; and NIRSO,

$13.6 million.

Naval Computer and Telecommunications

Centers

The Naval Computer and

Telecommunications

Centers provide regional

communications and

automated information

systems services to

customers; manage

remote facilities; provide

local information systems

support in coordination

with Defense

Information Systems Agency (DISA) information

processing centers; and design, develop, and

maintain standard DON automated information

systems.

The flow of information in the Navy can be

classified into two broad categories: message

information and data information. NCTC melds

communication and computer technologies to

provide its global customer base with advanced

automated information systems.

Effective 1 October 1999, the NWCF portion

of NCTC became a part of the Space and

Naval Warfare Systems Centers (SSCs). The

NCTC support centers have retained their

geographical locations, but control of the

centers has been assigned to SSC Charleston

and SSC San Diego as follows:

Effective 1 October 2000, all financial reporting

for the centers is consolidated in the Research

and Development sub-activity group for either

SSC San Diego or SSC Charleston. The only

accounts that will remain open will be those

required to support the residual accounting

effort for one year.

Operating Results

SSC Charleston Washington, D.C.

Pensacola, Florida

Norfolk, Virginia

Jacksonville, Florida

SSC San Diego San Diego, California

Pearl Harbor, Hawaii

Space and Naval Warfare Geographic Location

Systems Center

Senator Charles Robb receives

an on-hands demonstration by

getting his hand scanned for

access purposes to the new

Smart Card Technology Center.

A view of the satellite dish

arrays at the N aval Computer

and Telecommunications

Area Master Station in

Honolulu, HI.

13

NAV Y WO R K I NG CA P T I A L FU N D

O ve rv i e w

Navy Working Capital Fund

Navy, Fleet Material Support Office

The mission of the Navy, Fleet Material

Support Office (FMSO) is to employ information

technology for the design, development,

integration, and maintenance of automated

information systems for Navy, DoD, and other

Federal agencies, with specific emphasis on

systems supporting Naval supply, inventory and

material management, financial processing, and

maintenance operations.

From its two Naval Support Stations, one in

Mechanicsburg, PA, and one in Philadelphia,

PA, FMSO continues to operate as the first and

only Navy activity to achieve a Capability

Maturity Model (CMM) level IV rating, placing

it in a select group of software (Maintenance

and Development) agencies. Fewer than 3

percent of all DoD activities have a rating of IV

or higher.

The FMSO vision is to produce quality

products on time and in full partnership with its

customers. FMSO’s commitment to this vision

is evidenced by its support of the Navy Supply

System Command’s effort to improve its

business processes. FMSO supplied a team of

approximately 100 personnel to support the

Enterprise Resource Planning (ERP) project, a

private industry initiative undertaken by

NAVSUP. The goal of ERP is to develop a

business management system that integrates all

facets of business, including strategic planning,

manufacturing, sales, distribution, human

resources, and reporting. FMSO’s contribution

to the business case analysis of the project and

its recommendation of business software is

crucial to the success of ERP.

Operating Results

The Defense Finance and Accounting Service

charges for services provided contributed to

the actual Operating Result exceeding the

planned amount by $698 thousand.

Naval Reserve Information Systems Office

The Naval Reserve Information Systems Office

provides quality information management and

information technology products, services, and

solutions to satisfy requirements of the Navy, the

DoD, and other government agencies; and

performs other functions and tasks as directed

by a higher authority.

Effective 1 October 2000, control of the Naval

Reserve Information Systems Office (NIRSO)

was transferred from the Commander Naval

Systems Office to the Space and Naval Warfare

Systems Centers (SSCs). With this realignment,

the name of this activity changed to SPAWAR

Information Technology Center (ITC) New

Orleans. The effects of the realignment are

rather complicated. For FY 2001, the

operations of this activity will continue to be

included in the NWCF. In FY 2002 (1 October

2001), however, the activity will be absorbed

by the General Fund; only the residual

accounting, rather than results of operations,

will be included in the NWCF from that

point forward.

Operating Results

FY 2000 Operating Results were $282,000

higher than planned, in large part due to a

credit labor adjustment of approximately

$200,000.

Overview

NAV Y WO R K I NG CA P T I A L FU N D

14

FY 2000

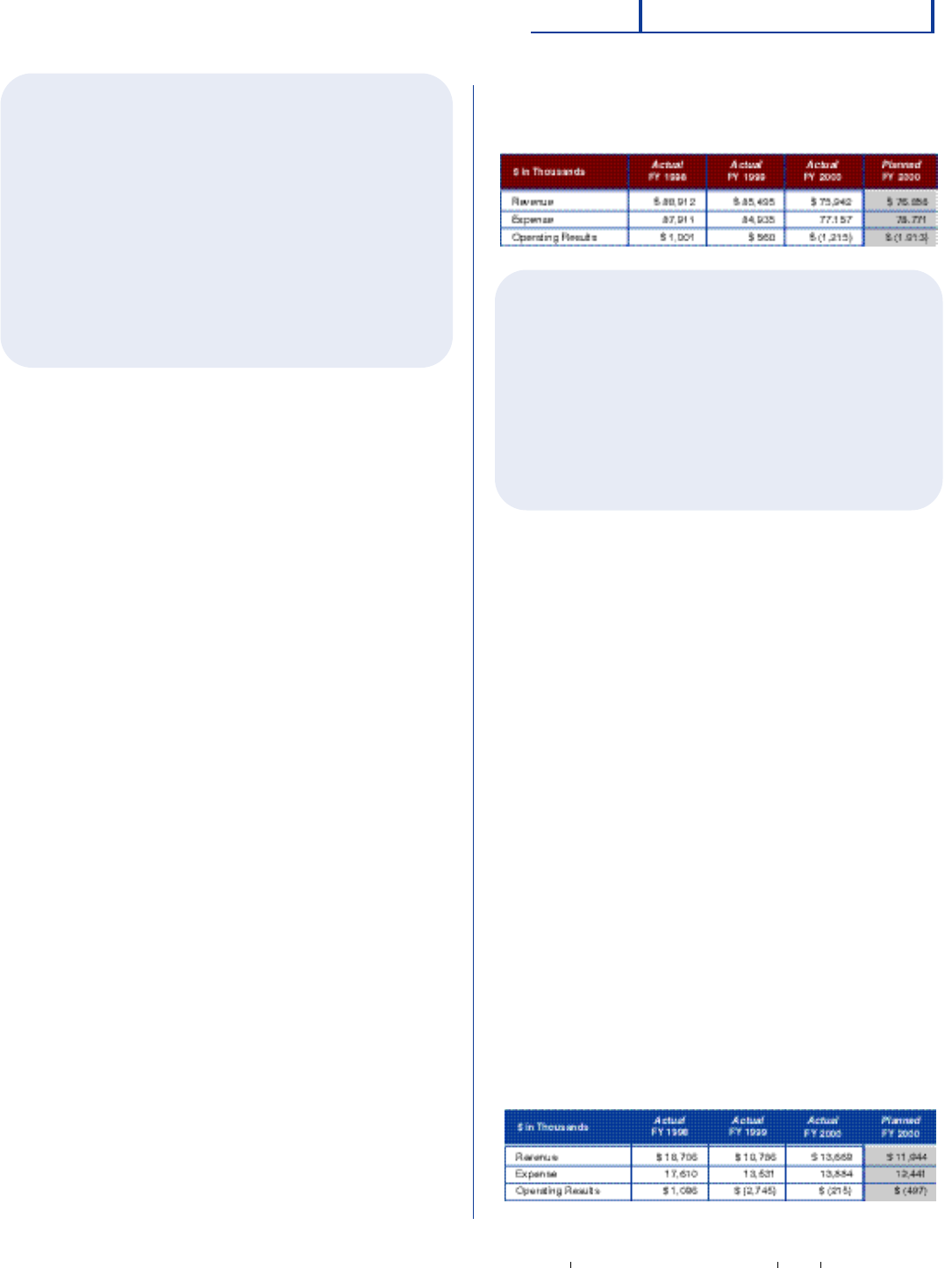

Research and Development

The Research and Development activity group

generated $7.8 billion dollars in FY 2000,

representing 37.7 percent of total NWCF

revenue. The group is divided functionally into

five subactivities, contributing revenues to the

activity group as follows:

Naval Surface Warfare Center

The Naval Surface Warfare Center operates the

Navy’s full spectrum research, development,

test and evaluation, engineering and fleet

support center for ship hull, mechanical, and

electrical systems; surface ship combat systems;

coastal warfare systems; and other offensive

and defensive systems associated with

surface warfare.

The Naval Surface

Warfare Center

(NSWC) is

dedicated to the

production of

advanced weapon

products for the

readiness and the

advancement of

the Navy of the 21st Century. NSWC is

organized into five divisions— Carderock,

Crane, Dahlgren, Indian Head, and Port

Hueneme—and the Naval Warfare Assessment

Station, Corona.

Operating Results

Actual FY 2000 Operating Results were $13.1

million above plan, in large part because of the

execution of more direct labor hours than

estimated.

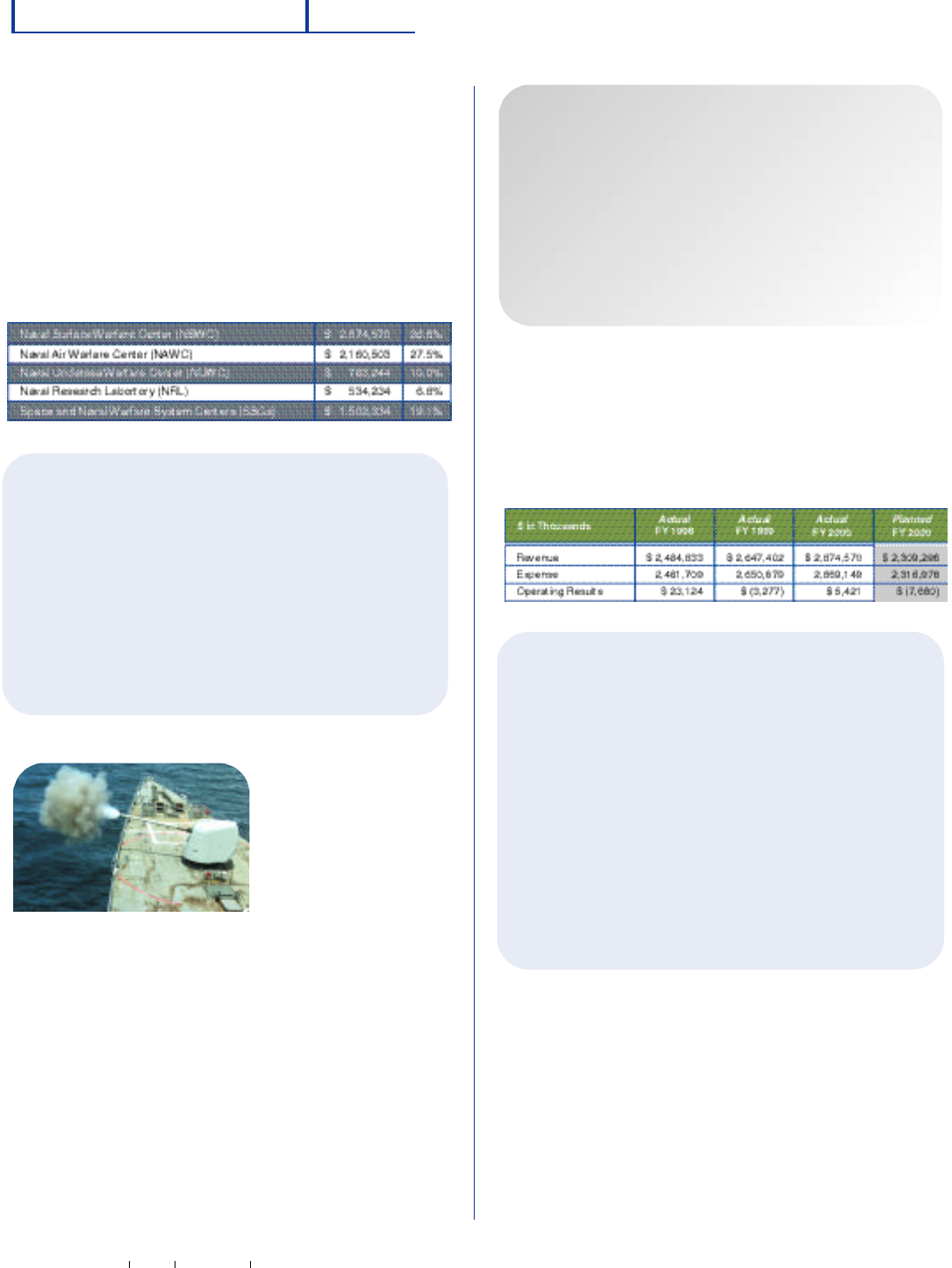

Naval Air Warfare Center

The Naval Air Warfare Center operates the

Navy’s full spectrum research, test, and

evaluation, in-service engineering, and Fleet

support activity for naval aircraft engines,

avionics, and aircraft support systems,

ship/shore/air operations, weapons systems

associated with air warfare, missiles and missile

subsystems, aircraft weapons integration, and

airborne electronics warfare systems. The center

also operates the department’s air, land, and sea

test ranges.

The Naval Air Warfare Center (NAWC) has two

divisions supporting its mission objectives:

The NAWC Aircraft Division (NAWAD) is the

Navy’s full spectrum research, development,

test and evaluation (RDT&E), engineering, and

USS Caron fires its five-inch guns in

a live fire exercise on Vieques,

Puerto Rico.

T

he NSWC Crane Division was recognized

for its innovative efforts to reduce costs

with two DoD Value Engineering Awards:

for its work with the AN/ALQ Electronic

Countermeasures system; and for its part

in developing new battery designs with

tri-service applications and benefits.

15

NAV Y WO R K I NG CA P T I A L FU N D

O ve rv i e w

Navy Working Capital Fund

fleet support center for air platforms. Its product

areas include aircraft systems technology,

propulsion, flight test and engineering, avionics

design and production, and the aircraft-platform

interface.

The NAWC Weapons Division combines the

resources of its sites in China Lake, CA and Pt.

Mugu, CA to provide the Navy and DoD with

effective and affordable integrated warfare

systems and life cycle support to ensure

battlespace dominance.

Operating Results

FY 2000 Operating Results were $3.9 million

below plan. This is attributable to several factors,

including increases in labor acceleration costs

and increased costs associated with the

implementation of the Defense Industrial

Financial Management System (DIFMS).

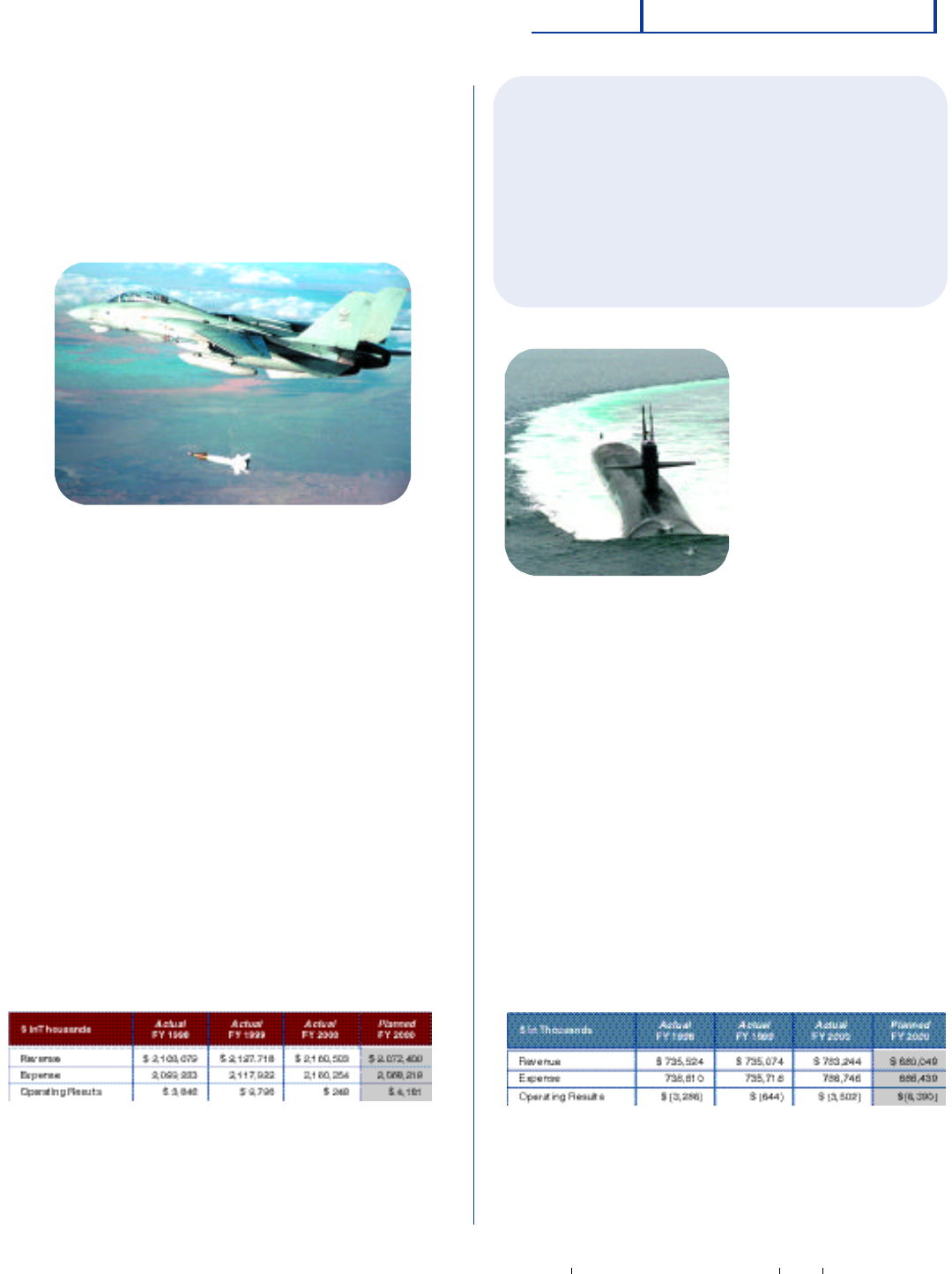

Naval Undersea Warfare Center

The mission of the Naval Undersea Warfare

Center is to operate the Navy’s full-spectrum

research, development, test and evaluation,

engineering, and fleet support center for

submarines, autonomous underwater systems,

and offensive and defensive weapon systems

associated with undersea warfare.

The Naval Undersea

Warfare Center

(NUWC) is

supported by two

divisions: Division

Newport, located in

Newport, RI, and

Division Keyport, in

Keyport, WA.

In addition to these

two main sites,

NUWC has several

smaller detachments

across North

America, ranging from Andros Island in the

Bahamas to Lualualei, HI, and from San Diego,

CA to Nanoose, British Columbia.

Operating Results

FY 2000 Operating Results exceeded plan by

$2.9 million, primarily because NUWC

executed more direct labor hours than

originally planned.

An F-14B “Tomcat” drops a GBU-16 laser guided bomb

during a live fire training exercise.

USS Alabama (SSBN 731) cruises at

high speed on the surface as she

approaches the Naval Submarine

Base at San Diego following the

completion of the sub’s 50th

deterrent patrol.

Overview

NAV Y WO R K I NG CA P T I A L FU N D

16

FY 2000

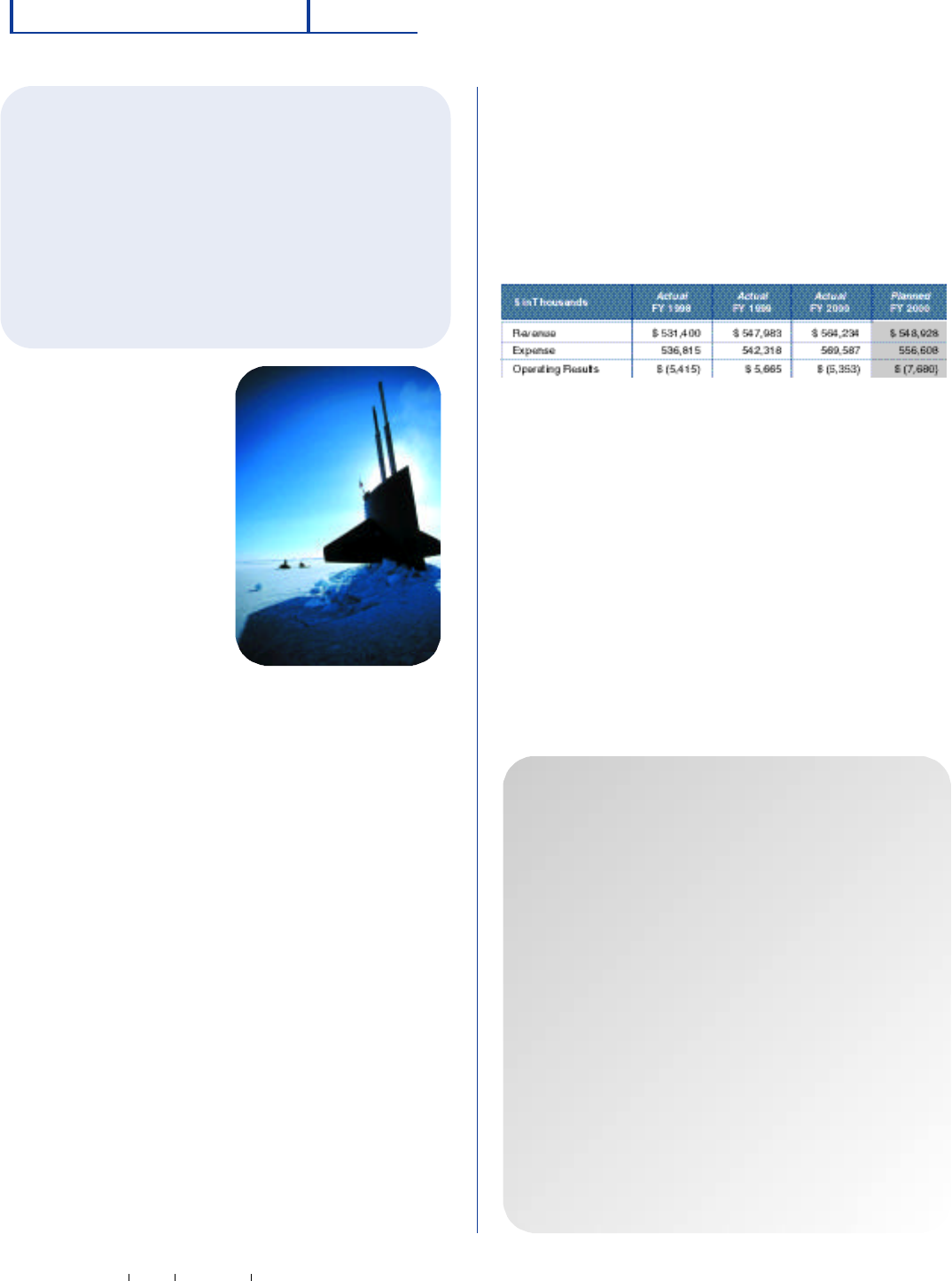

Naval Research Laboratory

The Naval Research Laboratory conducts a

broad-based multidisciplinary program of

scientific research and advanced technological

development, directed toward maritime

applications of new and improved materials,

techniques, equipment, and systems, and

development of ocean, atmospheric, and space

sciences and related technologies.

Serving as the Navy’s

corporate laboratory,

Naval Research

Laboratory (NRL)

product lines include:

• Broad research of

natural science,

including long-

range research, in

areas of interest to

the Navy.

• Exploratory and

advanced

technological

development

deriving from or appropriate to the scientific

program areas.

• Development of prototype systems

applicable to specific projects within areas of

technological expertise.

• Space technology and space systems

development and support.

• Mapping, charting, and geodesy (MC&G)

research and development for the National

Imagery and Mapping Agency.

In its role as the Navy’s corporate laboratory,

NRL supports scientific research and

development for other Navy activities and,

where qualified, for other DoD and

government agencies.

Operating Results

FY 2000 operating results, although negative,

were higher than planned. With revenue and

expense levels remaining relatively stable,

operating losses are planned through

FY 2002 to reduce positive Accumulated

Operating Results.

Financial Management Improvement Initiatives

at NRL are consistent with the Navy Strategic

Sourcing Program in their incorporation of

A-76 studies, contract efficiencies, and

functionality assessments.

1. In FY 2000, NRL completed a study of

administrative services, concluding that the

function should be retained in-house.

Additional A-76 studies are planned for

supply operations (FY 2001), audio-visual

Improved Predictions of Tropical

Cyclone Tracks

T

ropical cyclones can adversely affect the

military in many ways, from impacting

specific missions to affecting routine daily

activities in port. NRL has consequently

developed and demonstrated a global

numerical weather prediction system, the

Navy Operational Global Atmospheric

Prediction System (NOGAPS), that has the

ability to predict the path of tropical

cyclones. Recent enhancements to this

system, undertaken following research

within the academic community, have led to

significant improvements in the ability of

NOGAPS to predict tropical cyclone tracks.

USSHawbill (SSN 666) surfaced

at ice camp APLIS (Applied

Physics Laboratory Ice Station).

Hawbill is at the North Pole in

support of the Science Ice

Expedition.

17

NAV Y WO R K I NG CA P T I A L FU N D

O ve rv i e w

Navy Working Capital Fund

services (FY 2001), and management

information systems (FY 2002).

2. NRL will assess the potential of alternative

contracting processes to reduce contract

costs. Procedures that will be evaluated

include the use or further use of single

process initiatives, milestone-based progress

payments, and/or the consolidation of

contracting requirements.

3. NRL is continuing its program of

concentrating research division personnel

into a smaller number of buildings at the

Washington, D.C. site. Older, unused

buildings will be demolished, reducing

operating, maintenance, and upkeep costs.

Space and Naval Warfare System Centers

The Space and Naval Warfare Systems Centers

serve as the Navy’s full spectrum research,

development, test and evaluation, engineering,

and fleet support centers for command, control,

and communication systems and ocean

surveillance. The centers are also responsible for

integrating those systems that overarch

multiplatforms.

The Space and Naval

Warfare Systems Centers

(SSCs) provide the

scientific and technical

expertise, facilities, and

understanding of defense

requirements necessary

to ensure that the Navy

can develop, acquire, and

maintain the warfare

systems it needs to meet

current and emerging

requirements. In FY 2000,

this mission was

supported by two

Centers:

SSC Charleston designs, builds, tests, fields,

and supports the Navy’s frontline command,

control, communications, computers,

intelligence, surveillance, and reconnaissance

(C4ISR) systems.

SSC San Diego is responsible for development

of the technology to collect, transmit, process,

display, and, most critically, to manage the

information that is essential to naval operations.

Operating Results

FY 2000 Operating Results were $21.4 million

above plan due to the SSCs handling more

workload than planned. This resulted in

increased direct labor hours, which in turn

generated more overhead than was spent.

Advanced Human-Computer

Interface (AHCI)

S

SC San Diego completed in FY 2000 the

development of an advanced human-

computer interface that includes the Open

System Advanced Workstation (OSAW) and

Display User Enhancement Technology

Systems (DUETS). OSAW offers next-

generation workstations for command and

control systems by integrating state-of-the-art

technologies, including flat-panel displays,

touch screens, speech recognition, and 3-D

audio localization. OSAW work continues

under DUETS, a program that provides

common tactical pictures of the battlespace

in 3-D to the tactical action officer in the

combat information center. The AHCI

(OSAW/DUETS) offers a cost-effective, user-

centered, and mission-relevant 3-D tactical

display system with multimodal human-

computer interfaces.

An Operations Specialist plots a

adar contact on a Dead Reckoning

acer (DRT) in the Combat

nformation Center (CIC) aboard

USS Belleau Wood (LHA 3).

Overview

NAV Y WO R K I NG CA P T I A L FU N D

18

FY 2000

Supply Management

The Navy and the Marine

Corps are represented by

separate subactivities

within the Supply

Management activity

group. In FY 2000, Supply

Management accounted for

$5.4 billion of total NWCF

revenue, or 26.3 percent.

Navy Supply Management

generated $5.2 billion and

Marine Corps Supply

Management, $166 million.

Navy Supply Management

The mission of the Navy Supply Management

Activity is succinct: “To provide Navy, Marine

Corps, Joint, and Allied Forces with quality

supplies and services.”

The worldwide, integrated Navy Supply System

gets the Fleet what it needs, where and when it

needs it. This supply activity is supported

through the Naval Inventory Control Point

(NAVICP), headquartered in Philadelphia, PA;

two sites in Mechanicsburg and Philadelphia,

PA; and six Fleet and Industrial Supply Centers

(FISCs).

NAVICP exercises centralized control over

350,000 different line items of the repair parts,

components, and assemblies that keep ships,

aircraft, and weapons operating. NAVICP also

provides logistic and supply assistance to

friendly and allied nations through the Foreign

Military Sales program.

The FISCs provide a variety of logistics support

services and products to Navy and other

military customers. These products and

services include material

management, contracting,

transportation, fuel services,

customer service,

hazardous materials

management, household

goods movement

support, consolidated mail

services, and supply

consultation.

Operating Results

For supply-type activities,

the most effective

performance measure is a comparison of

operating results over time, rather than a

comparison of planned and actual results.

Between FY 1998 and FY 1999, the Operating

Result fell, largely due to a clean-up of the

Central Data Base (CDB) subsequent to the

conversion of ships and stock points to an

inactive status (i.e., through base realignment

and closure (BRAC) and decommissioning). The

FY 2000 Operating Results showed a return to

a positive figure, but it should be noted that the

result was significantly influenced by the

capitalization of aviation depot-level repairable

(AVDLR) inventories aboard aviation-capable

ships and with the Marine Aviation Logistics

Squadron.

The Naval Supply Systems Command and the

Defense Finance and Accounting Service

(DFAS) recently completed a project that will

dramatically improve the Navy’s financial

accountability and control of funds used to

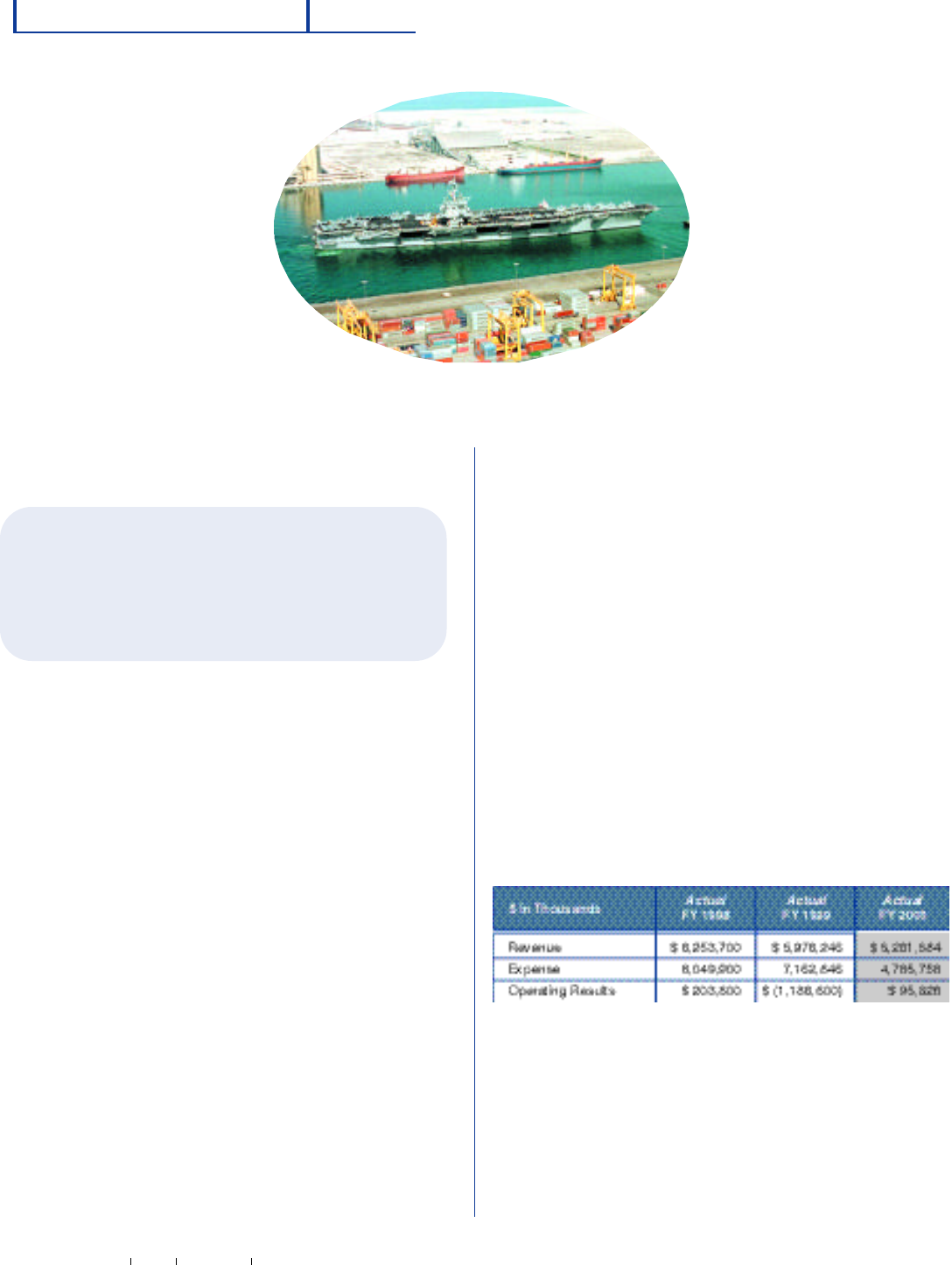

The aircraft carrier USS Enterprise (CVN 65) enters the port of Jebel

Ali (Dubai), United Arab Emirates.

19

NAV Y WO R K I NG CA P T I A L FU N D

O ve rv i e w

Navy Working Capital Fund

procure equipment, supplies, and services.

The new system provides faster and better

access to data, improving financial

management efficiency.

The Fleet Material

Support Office

partnered with

NAVSUP and

DFAS to create,

develop, and

incorporate two

new modules for

the Navy’s Material

Financial Control

System (MFCS).

The new modules,

referred to as the

Allotment Accrual

Accounting

Module (PX02) and

the Expenditure

Processing Module

(PX04), replaced a mainframe system of

approximately 1 million lines of computer

code. These modules are compatible with the

Internet-ready, flexible, and secure client/server

architecture that provides such key benefits as

system security, expandability, and scalability.

Navy personnel received extensive training on

the new modules, enabling the operation to be

self-sustaining from its inception. No outside

consulting resources are required for day-to-day

operations and maintenance.

Marine Corps Supply Management

The Marine Corps Supply Management activity

supports the Fleet Marine Force, the Navy, and

the Department of Defense by providing

consumable and reparable items essential to the

mission of its customers.

Marine Corps Supply Management consists of

both retail and wholesale operations. Retail

operations are performed primarily under the

Direct Support Stock Control (DSSC) concept.

Under this concept,

fast-moving items in

support of base or

station functions are

stocked at issue

points close to the

customer. Currently,

the Marine Corps

operates nine DSSC

activities, namely,

Quantico, Parris

Island, Camp

LeJeune, Albany,

Barstow, San Diego,

Twentynine Palms,

Camp Pendleton,

and Camp Butler. In

addition to DSSCs,

the Marine Corps

manages one Inventory Control Point (ICP) at

the Marine Corps Logistics Base in Albany, GA.

As the wholesale component of the supply

management business area, the ICP supplies

Marine Corps-managed consumable and

reparable items to the Fleet Marine Force

(FMF) and other customers.

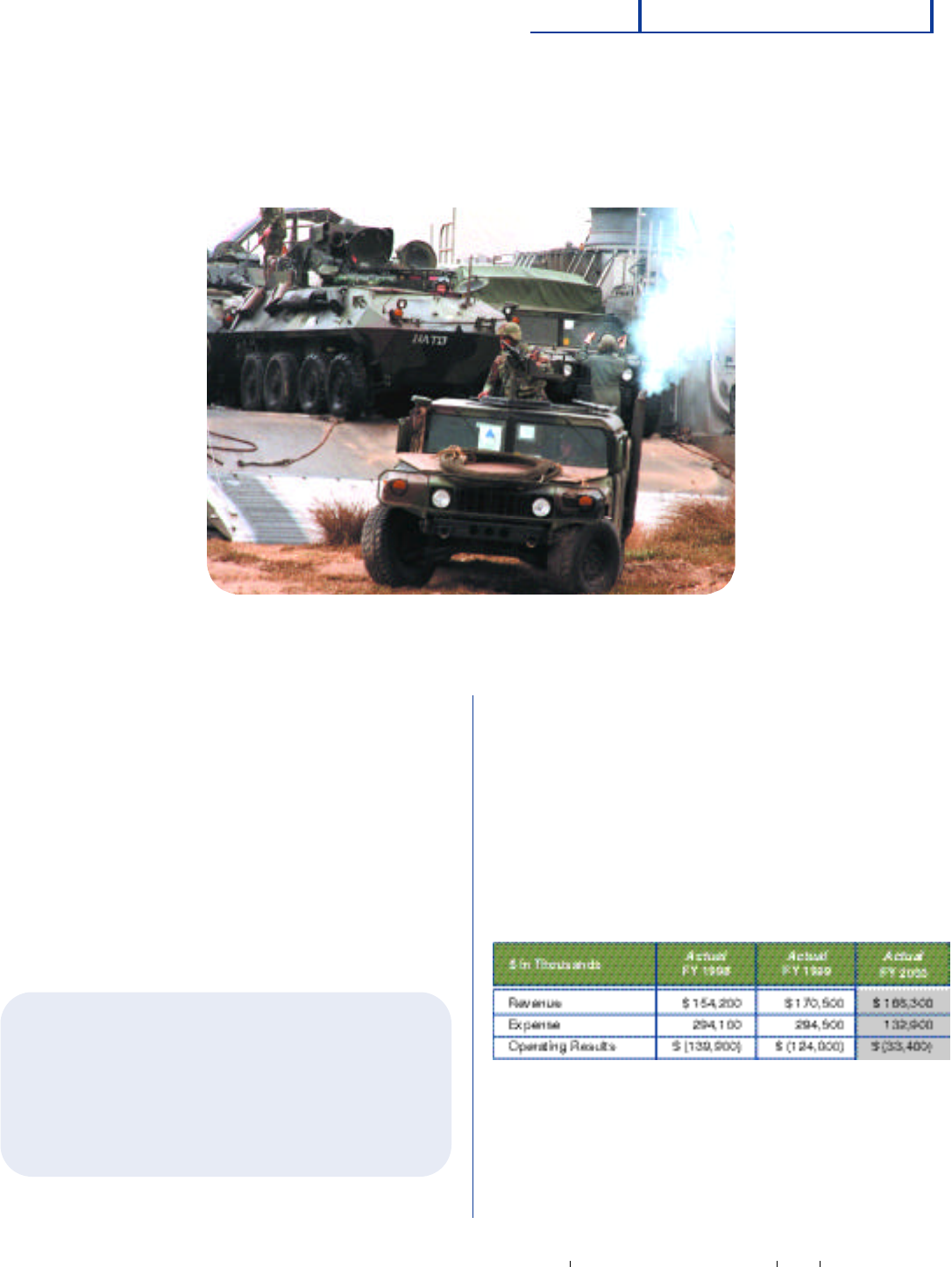

Operating Results

Marines from the 24th Marine Expeditionary Unit Special Operations Capability

(SOC) disembark from a Landing Craft Air Cushion (LCAC) as part of Operation

Dynamic Mix 2000.

Overview

NAV Y WO R K I NG CA P T I A L FU N D

20

FY 2000

Performance Measurement

Objectives of the Navy Working

Capital Fund:

The NWCF activity groups share common

operating objectives, against which their

performance is measured. These objectives

include:

• Ensuring, through effective cash

management, that there are sufficient cash

reserves to maintain responsiveness to

customer requirements.

• Producing the high-quality goods and

services that support the mission of the

DON and the operational objectives of

other customers.

Cash Management

NWCF Objective: To ensure, through effective

cash management, that there are sufficient cash

reserves to maintain responsiveness to

customer requirements.

The operational model of the NWCF activities

requires that the activity secure and deliver the

goods or services required by the customer

before it is reimbursed for the cost of providing

those goods or services. To ensure that the

NWCF has adequate cash reserves to cover

the cost of goods and services sold until

reimbursement is received, the USD (C)

recommends a cash balance be maintained

that is equal to seven to 10 days of operating

cash disbursements plus six month’s balance of

capital expenditures.

For FY 2000, the target cash balance to meet

this recommendation was $668 million (seven

days) to $890 million (10 days). Not only did

the NWCF meet this target but, as FY 2000

closed, the cash position more than met the

recommended 10-day level, the result of

unanticipated sales growth experienced by

Supply Management, Navy and workload

above budgeted levels in the Research and

Development activity group. This strong FY

2000 performance should ensure that the

NWCF continues to accommodate cash flow

requirements needed to meet customer

demand for services.

Customer Support

NWCF Objective: To produce the high-quality

goods and services that support the mission of

the DON and the operational objectives of

other customers.

The volume of work performed by the NWCF

activities is indicated by the revenue that the

NWCF generates. The distribution of that

revenue by source indicates the relative

importance of each customer to the operations

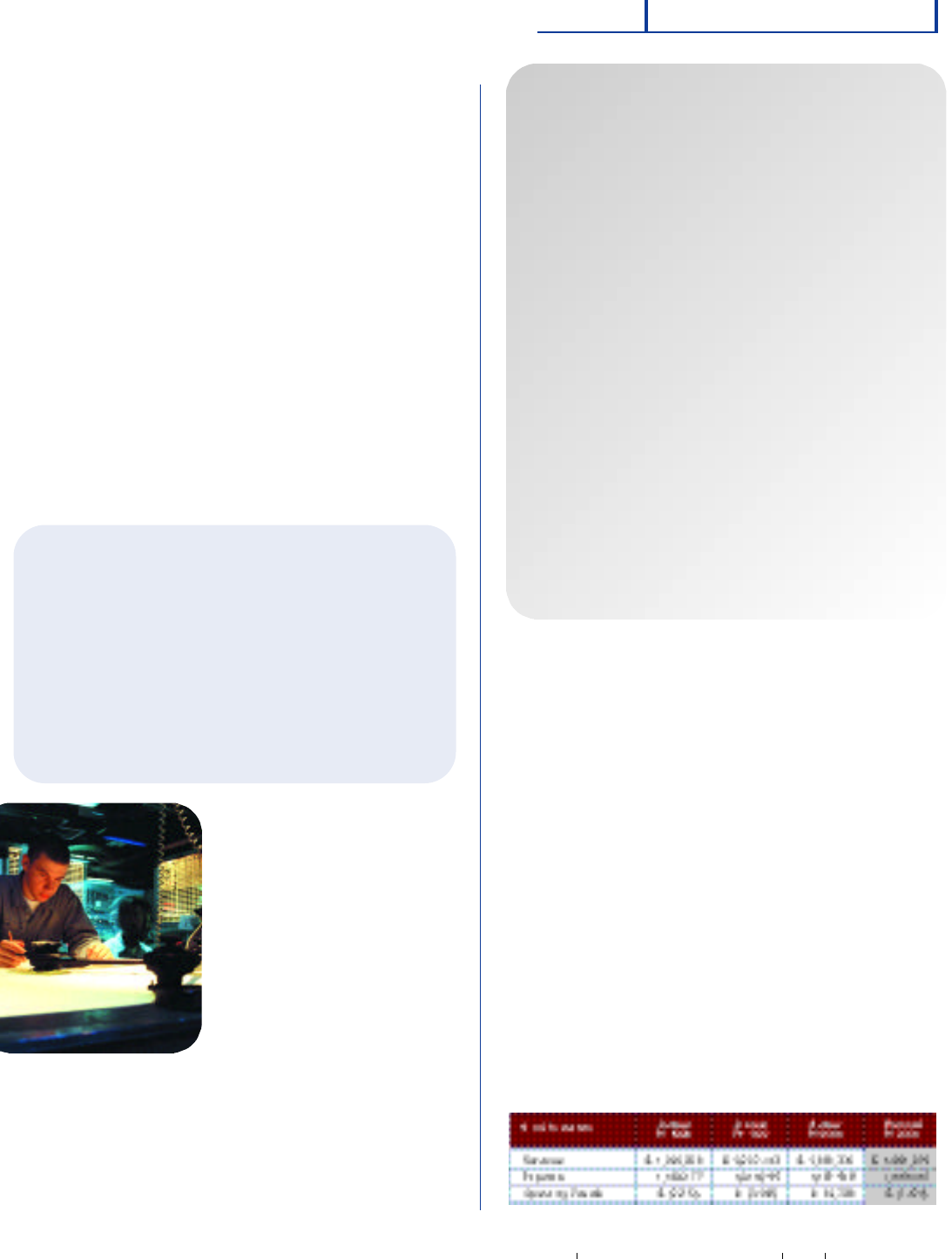

of the NWCF. The table below illustrates the

total NWCF Revenue for FY 1998 through FY

2000, by customer. The figures for FY 1998 and

FY 1999 include revenue attributed to the

Ordnance activity group, which was transferred

to a mission-based or General Fund activity in

FY 2000. The Ordnance revenue, the NWCF

customer base for the past three years is

shown below:

21

NAV Y WO R K I NG CA P T I A L FU N D

O ve rv i e w

Navy Working Capital Fund

Challenges and

Opportunities

The challenges and opportunities facing the

NWCF activity groups are the same challenges

that face any complex business organization in

a global market. These challenges include:

• Continuing the delivery of excellence

with a shrinking workforce.

• Reducing or eliminating advance billings

to more effectively manage the cash

balance of the NWCF

• Implementing financial management

and process improvements through

nonfinancial feeder teams.

• Maintaining Financial Management

Systems in compliance with current

regulatory guidance.

• Reevaluating the methods and processes

for assessing managerial control risks.

Personnel Resources

One of the challenges facing the NWCF is how

to maintain or improve current levels of service

as its workforce shrinks. To counter this

challenge, the NWCF has adopted automated

processes, outsourcing techniques, and other

innovative solutions to ensure that its

customers continue to receive the best

possible service.

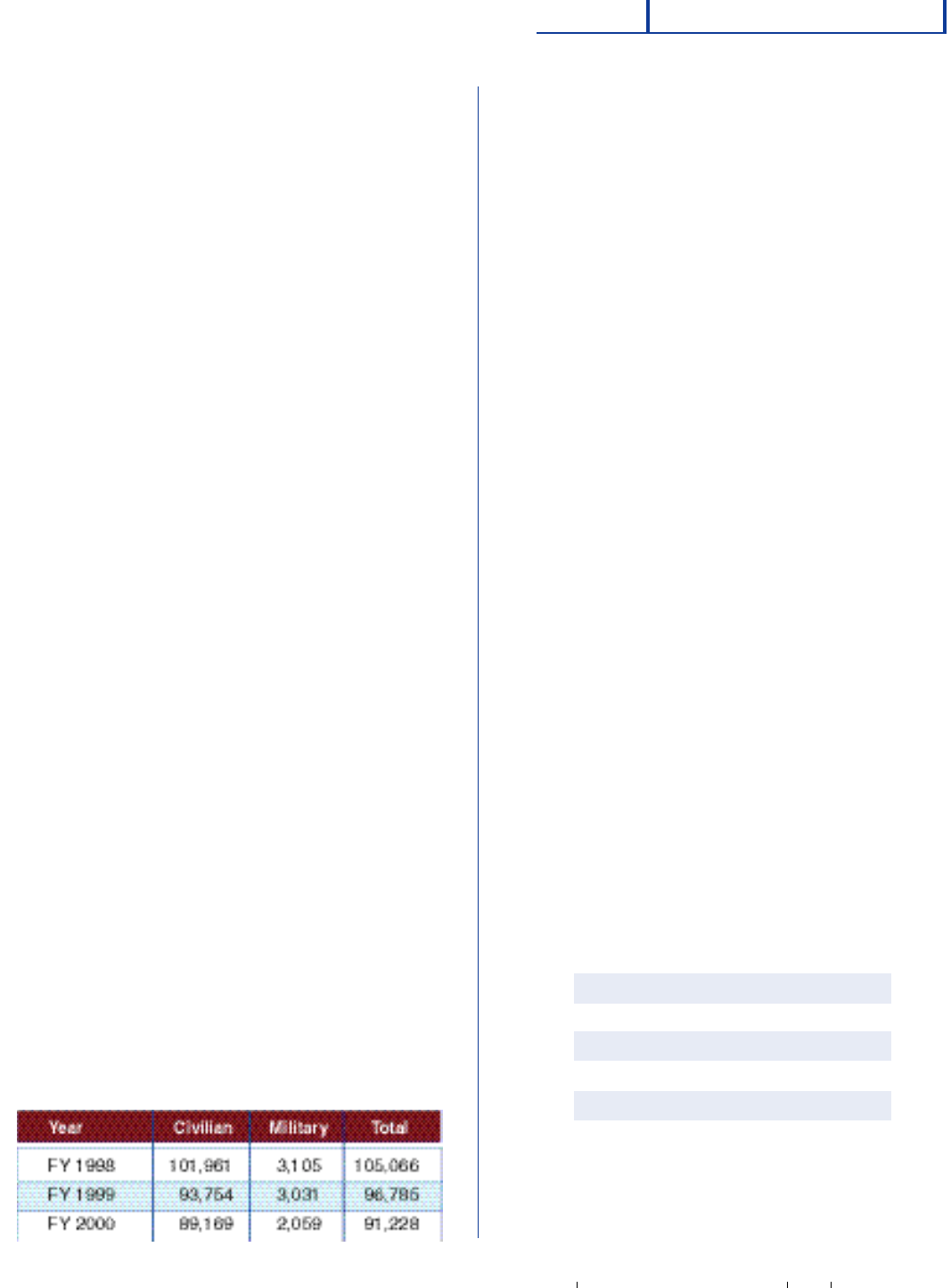

The following table illustrates the continued

downward trend for the numbers of civilian

and military personnel engaged in the missions

of the NWCF activity groups:

Cash Management: Advance Billings

To improve short-term cash solvency,

customers may be billed in advance of service

or product delivery. But while these advance

billings improve the ready cash balance, they

do not change the customer work schedule or

reduce the cost of filling the customer order.

In 1995, when the responsibility for managing

the cash balances was returned to the

individual components, the NWCF received a

$442 million cash balance and responsibility for

a $2.2 billion liability for advance billings. The

NWCF then faced the challenge of filling the

orders associated with these advance billings,

requiring further outlay of cash, while

simultaneously rebuilding the cash balance to

provide sufficient resources to cover seven to

10 days of operating requirements.

The NWCF instituted an aggressive cash

recovery plan to rebuild a positive cash

position. The objectives of the plan were

threefold: to eliminate the $2.2 billion liability

for advance billings; to maintain cash balances

equal to seven to 10 days of operating

requirements; and to cease new advance

billings. Through assessing cash surcharges,

the NWCF has steadily reduced its unliquidated

advanced billing balance to just $4 million at

the end of FY 2000.

FY 1996 1.4 billion

FY 1997 638 million

FY 1998 291 million

FY 1999 55 million

FY 2000 4 million

Overview

NAV Y WO R K I N G CA P T I A L FU N D

22

FY 2000

Working Groups

In 1998, DoD initiated two efforts to speed its

progress toward an unqualified opinion: the

Biennial Financial Management Improvement

Plan and the DoD Implementation Strategies.

The Biennial Financial Management

Improvement Plan defines the environment the

DoD would like to attain in the future and

provides a concept of operations to guide

transition toward this environment. The DoD

Implementation Strategies establish specific

milestones and tasks to be achieved when

addressing financial management initiatives and

deficiencies. These efforts complement one

another and provide the cornerstone of the

DON’s strategy to develop fully integrated

financial management systems. They mandate a

course of aggressive action, including:

• Reengineering business processes to

achieve an integrated, data-sharing

environment.

• Adopting a business philosophy that uses

a proprietary/budgetary financial

structure within a performance-oriented

financial management environment.

• Tracking the life cycle costs of property

assets from acquisition through usage to

final disposal.

• Establishing electronic exchanges or

system interfaces between standalone,

nonfinancial feeder systems and standard

accounting and reporting systems.

• Establishing a risk management

environment incorporating internal

controls such as competency training to

ensure data integrity and protection

against fraud.

Working Groups

The DON has created nonfinancial feeder

teams, or working groups, to oversee financial

management and process improvements and to

support DoD Implementation Strategies. Each

working group is led by a senior civilian or a

flag officer and includes broad representation

of program and financial personnel from the

Secretariat, Navy and Marine Corps

Headquarters, the audit community (General

Accounting Office, DoD Inspector General,

and Naval Audit Service), DoD agencies, and,

where appropriate, contractor support. In

addition, a representative from each working

group attends Executive Steering Committee

(ESC) meetings with staff of the Office of the

Under Secretary of Defense (Comptroller).

DON Working Groups include:

• Plant Property and Equipment (Real,

Personal, National Defense, Heritage, and

Property in Possession of Contractors)

• Inventory and Operating Materials and

Supplies

• Deferred Maintenance

• Environmental Restoration and Hazardous

Waste

• Time and Attendance and Personnel

Systems.

During FY 2000, the working groups continued

to change business practices, eliminate

redundant and manually intensive systems, and

bring remaining systems into compliance with

Federal Accounting Standards. All teams made

considerable progress, reaching different stages

of completion according to the complexity of

their implementation strategy.

Working group highlights

Real Property. The Navy Facility Assets Data

Base (NFADB) is the DON’s central repository

for land, building, and structure assets. Work in

FY 2000 focused primarily on raising the

accuracy of data (existence, completeness, and

23

NAV Y WO R K I NG CA P T I A L FU N D

O ve rv i e w

Navy Working Capital Fund

valuation) and on bringing the system into

compliance with federal accounting standards.

The team also identified the modifications

necessary to enable the calculation of

depreciation, and developed the internal

controls necessary to sustain accurate financial

reporting over the long term. The team will

continue to work with the Defense Finance and

Accounting Service (DFAS) to develop an

electronic interface with our Standard

Accounting and Reporting System (STARS)

during FY 2001.

Personal Property. This focus area is unique in

that it requires the implementation of a totally

new system, representing a significant change

in DON business culture and processes. The

DON chose to introduce the Defense Property

Accountability System (DPAS) as its standard

property accountability system, rejecting the

alternative of attempting to bring the hundreds

of existing local systems into compliance with

federal accounting standards—an option that

would have provided marginal improvement in

terms of overall accountability. Implementing

DPAS is an ambitious undertaking that will

require extensive personnel training to ensure

sustainability over the long term, but which

promises to improve management decision-

making and ensure accountability of assets.

Implementing DPAS has required the

development of new personal property policy,

operating procedures, and internal controls,

including audit-quality physical inventory

procedures. Work also continues with efforts to

develop a personal property catalog using

standard barcodes.

We made significant progress in FY 2000,

implementing DPAS at 140 sites that together

account for 99 percent of capital assets, by

dollar value (acquisition cost of $100,000 or

higher). Implementation will continue in FY

2001, as will the efforts to improve the financial

reporting of personal property. DPAS will

ultimately be implemented at more than 900

Navy activities.

In FY 2000, the Marine Corps completed DPAS

implementation, turning its attention to physical

inventory counts and reviewing the accuracy of

its database. During FY 2001, training for

personal property managers will stress

accountability and the importance of

maintaining the existence, completeness, and

valuation of property.

Heritage Assets. During FY 2000, the Heritage

Asset team clarified definitions and reporting

requirements and conducted an extensive

market survey to identify products suitable for

use in the managing of assets. The team

selected a property management and archive

system and plans to purchase the software in

January 2001, with implementation to begin

shortly thereafter. This effort is currently funded

through FY 2001. The team also began to

standardize asset management processes,

seeking to ensure the consistency of internal

controls with hierarchical policy. This policy

and process approach should ensure the

success and sustainability of internal controls

over the long term.

Government Property in Possession of

Contractors (GPPC). The working group

continued its efforts to identify an appropriate

approach to account for property and material

held by contractors. During FY 2000, DoD

completed a draft study to determine the

extent to which existing systems already

maintain accountability of GPPC, in an effort to

reduce areas of duplicate reporting and to

NAV Y WO R K I NG CA P T I A L FU N D

24

FY 2000

Overview

develop a methodology for collecting GPPC

information within the constraints of federal

regulations. A report has not yet been issued

in final.

Operating Materials and Supplies (OM&S).

During FY 2000, the OM&S team evaluated

business processes, put forth a strategy for

streamlining the number of feeder systems, and

identified eight major systems for compliance

evaluation. Working closely with the Office of

the Secretary of Defense (OSD), DFAS, and the

audit community, the team took steps to

implement a model for valuing OM&S for

financial statement purposes. System

modifications will be required once an OM&S

valuation model has been selected in order to

bring the systems into compliance with federal

accounting standards.

Inventory and Logistics. The team is reviewing

systems and processes for managing the

DON’s Inventory Held for Sale. The team is

ensuring that feeder systems comply with

financial requirements, that in-transit assets are

properly managed, and that physical inventory

sampling and counting are accomplished

according to DoD policy. The team is also

revising the current acquisition inventory

valuation method and studying the feasibility of

implementing a direct historical cost method of

valuation. In FY 2000, two new modules were

additionally introduced in the Navy’s Material

Financial Control System (MFCS), replacing a

mainframe system of approximately 1 million

lines of computer code. The new modules will

support the enhancement of system security,

expandability, and scalability.

Summary

The working groups are making considerable

progress in assessing and reengineering the

DON’s business processes toward realization

of a standard, compliant system enabling

streamlined data flow and effective internal

control. A major outcome of this process will

be the elimination of redundant systems and

the development of interfaces between finance

and accounting systems and subsidiary

systems. Once realized, a fully integrated

financial management system will support the

program/budget process, provide information

for internal decision making, and produce

auditable financial statements that are

sustainable over the long term.

Financial Management Systems

One of the specific requirements for an activity

to be included in the working capital fund

classification is that the activity be supported

by an accounting system that is capable of

collecting the costs of production and assigning

these costs to the appropriate outputs. The

activities of the NWCF are supported by

financial systems as varied as the specialized

contribution each makes to the support of the

Navy and the defense of the United States.

The challenge facing the NWCF is to establish

and maintain financial management systems

that not only support the unique business areas

of its activity groups, but which also meet the

regulatory requirements for a federal financial

management system.

To meet this challenge, the NWCF has been

working with the Defense Finance and

Accounting Service (DFAS) to implement a

number of migratory systems that will meet the

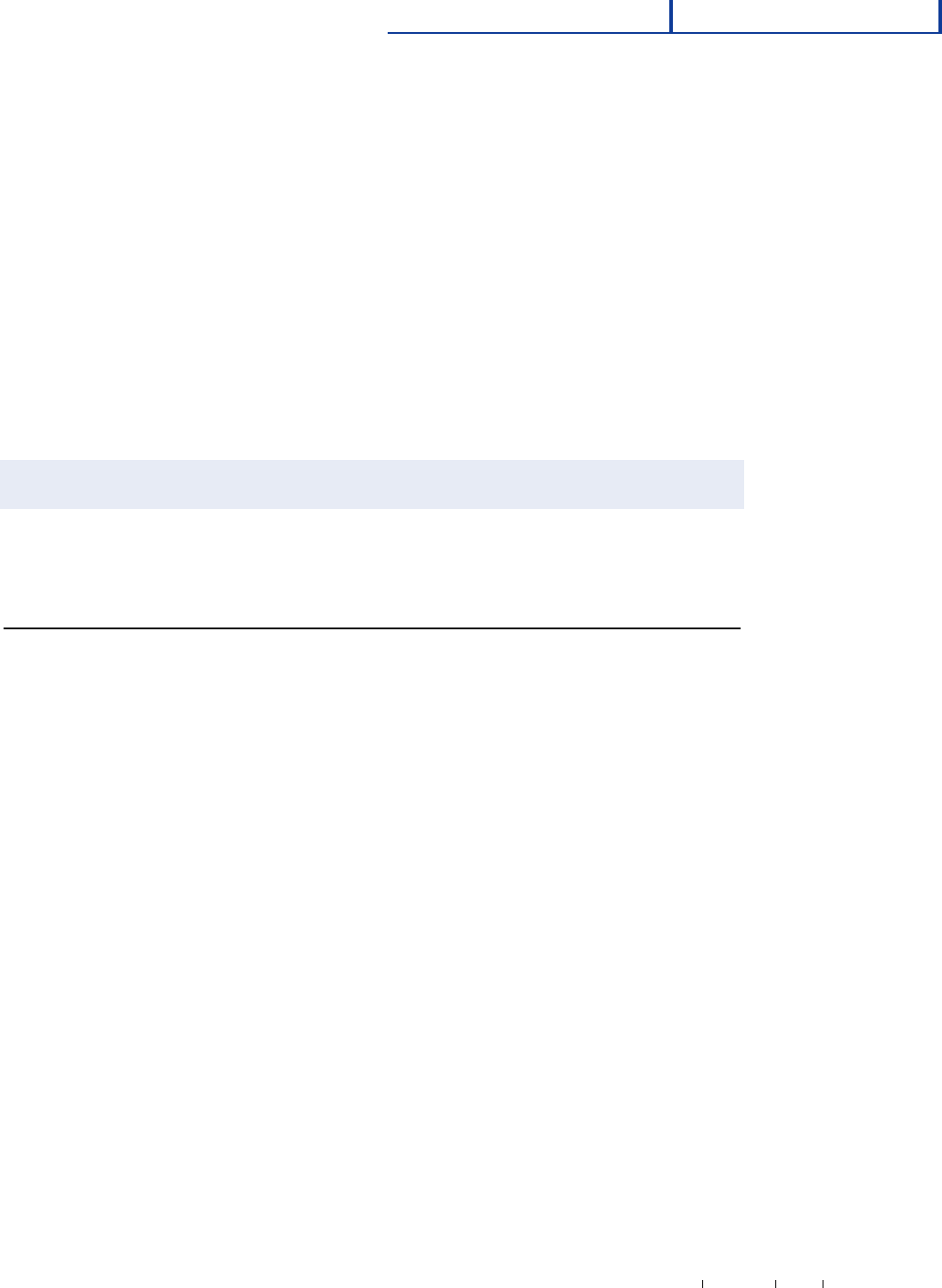

current standards for federal financial

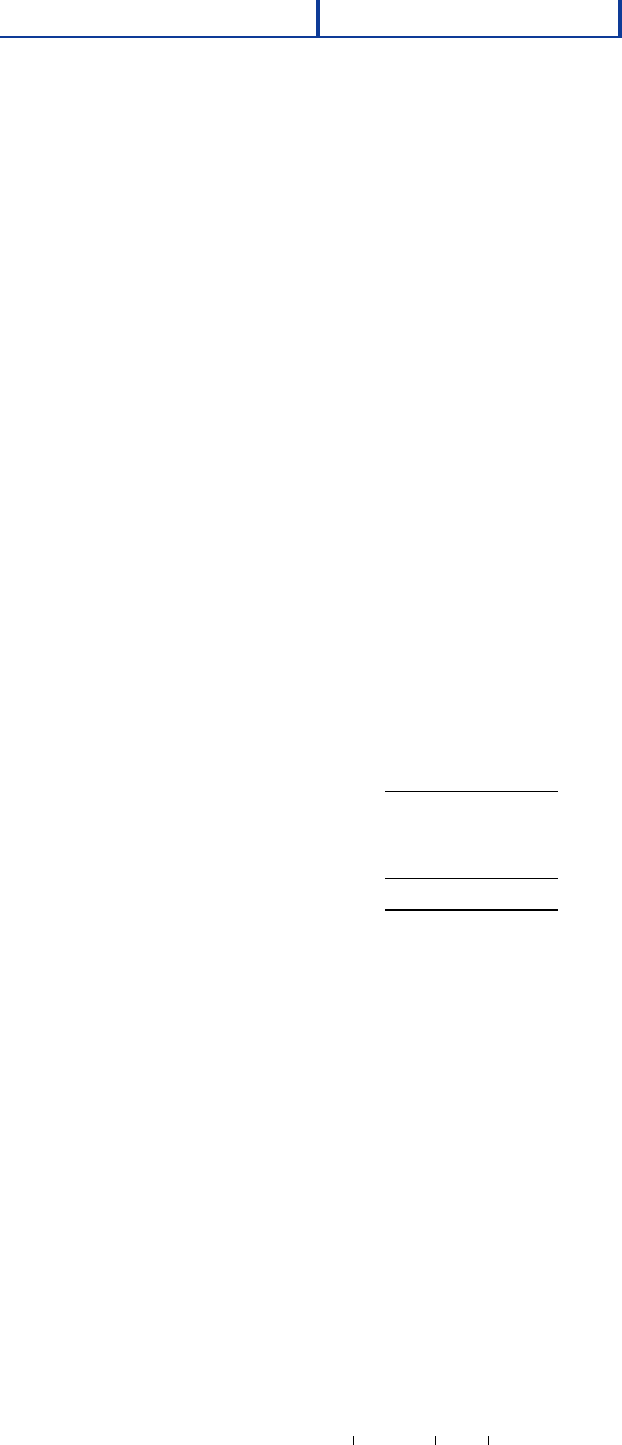

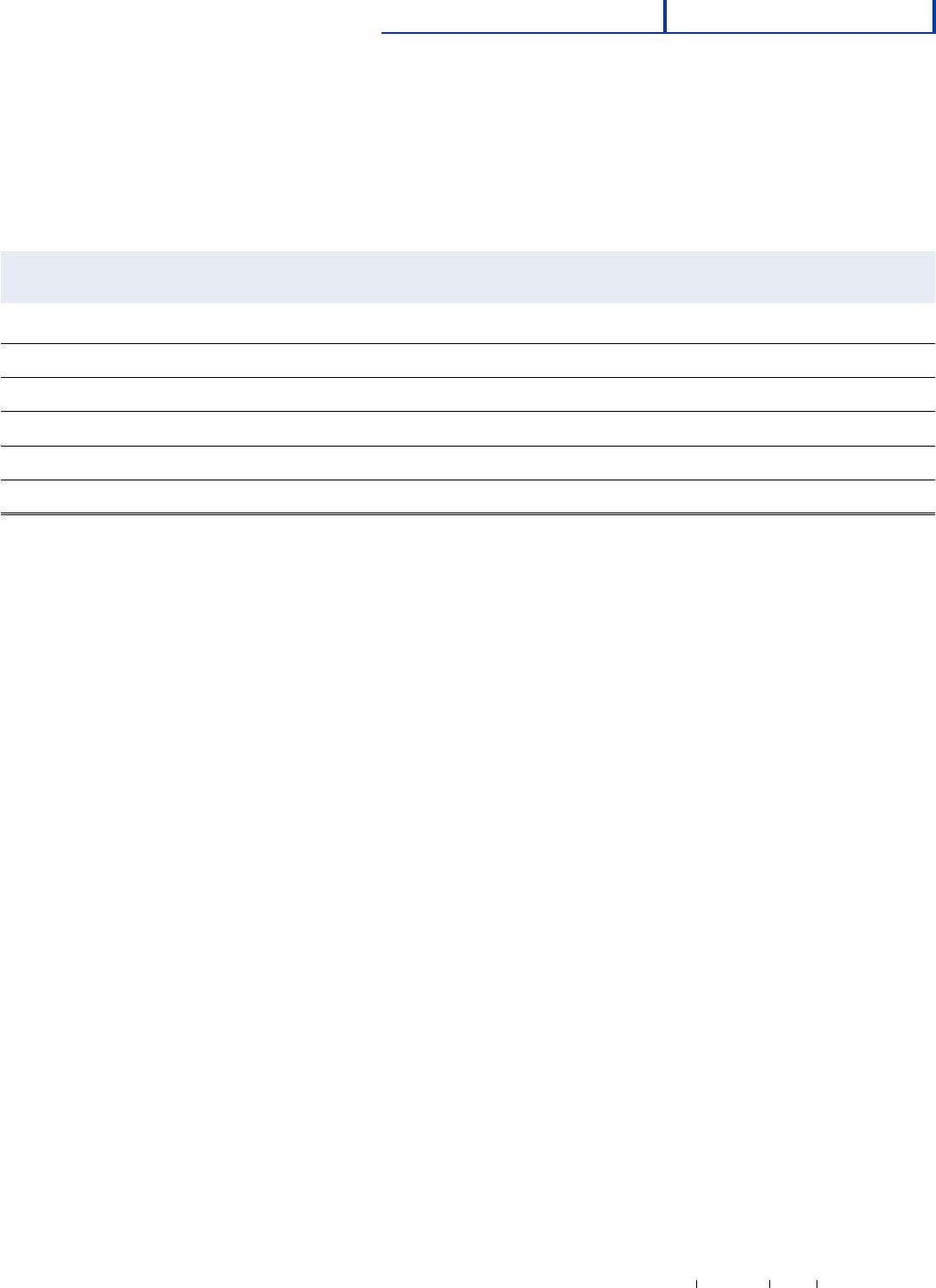

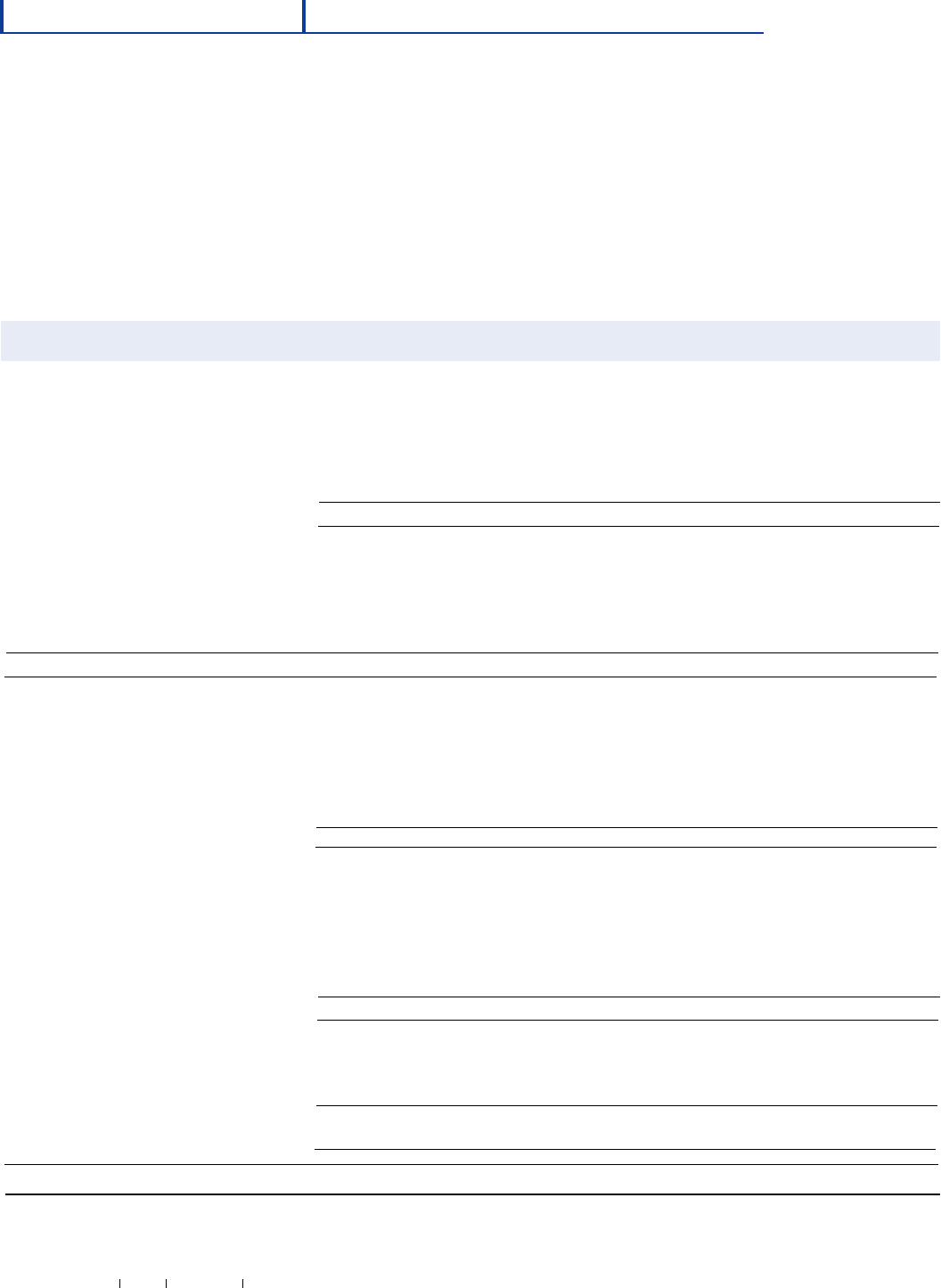

management systems. The table below

illustrates the financial management systems

supporting the NWCF activity groups. For

those activity groups where a legacy system is

in use, the targeted migratory system and

planned implementation date are also

displayed.

25

NAV Y WO R K I NG CA P T I A L FU N D

O ve rv i e w

Navy Working Capital Fund

Risk management Initiative

The expanding legal and regulatory

requirements, the powerful but vulnerable

Internet, and the uncertainties inherent in

maintaining an able, ready Naval force make it

difficult to provide assurance that effective

controls are in place to mitigate the risks

involved in managing the complex, global

organization that is supported by the NWCF

activity groups.

To address the challenge of effective risk

management, the Navy is reviewing its

traditional, reactive approach of monitoring

control weakness reporting. In its place, DON

plans to implement a new risk management

process that will be proactive and that will

invigorate the organization to create a cultural

change and awareness of risk management

effectiveness.

The cultural change and the paradigm shift

from the traditional reactive model to one that

is focused on early detection of potential

management risks and their associated control

weaknesses are being tested in a pilot program

by NAVFAC. This pilot program combines

elements of facilitation, group meetings, and

proactive resolution in a structured

environment. Although it is still too early to

evaluate the impact of the pilot program, the

initial reports have been positive.

NWCF Activity Group Legacy System Migratory System

Depot Maintenance–Shipyards Naval Shipyard Management TBD (April 01)

Information System (SYMIS)

Depot Maintenance–Aviation Defense Industrial Financial Management

System (DIFMS)

Depot Maintenance–Marine Corps Defense Industrial Financial Management

System (DIFMS)

Transportation Military Sealift Command Financial

Management System (MSCFMS)

Base Support Public Works Center Management DWAS (September 03)

Information System (PWCMIS)

Information Services Industrial Fund Accounting System (IFAS) Transfers to GF activity (October 01)

Defense Business Management CO-WCF

System (DBMS)

Research and Development Defense Industrial Financial Management

System (DIFMS)

Information Management/Processing DIFMS (October 01)

System(IMPS)

Naval Operations and Management DIFMS (January 02)

Information Systems (NOMIS)

Realtime Integrated Management IFMS (April 01)

System (RIMS) D

Supply Management, NAVICP Material Financial Control System (MFCS)

Supply Management, Marine Corps Marine Corps Unified Material ATLASSII

Management System (MUMMS)

NAV Y WO R K I NG CA P T I A L FU N D

26

FY 2000

Overview

27

FY 2000

AN N UA L FI NA NC I A L RE P O RT

Principal Statements

Department of the Navy

Navy Working Capital Fund

Principal Statements

28

FY 2000

NAV Y WO R K I NG CA P I TA L FU N D

Principal Statements

Limitations of the Financial Statements

The financial statements have been prepared to report the financial position and results

of operations for the entity, pursuant to the requirements of Title 31, United States Code,

section 3515(b).

While the statements have been prepared from the books and records of the entity, in

accordance with the formats prescribed by the Office of Management and Budget, the

statements are in addition to the financial reports used to monitor and control budgetary

resources which are prepared from the same books and records.

To the extent possible, the financial statements have been prepared in accordance with

federal accounting standards. At times, the Department is unable to implement all

elements of the standards due to financial management systems limitations. The

Department continues to implement system improvements to address these limitations.

There are other instances when the Department’s application of the accounting

standards is different from the auditor’s application of the standards. In those situations,

the Department has reviewed the intent of the standard and applied it in a manner that

management believes fulfills that intent.

The statements should be read with the realization that they are for a component of the

U.S. Government, a sovereign entity. One implication of this is that the liabilities cannot

be liquidated without legislation that provides resources to do so.

29

FY 2000

AN N UA L FI NA NC I A L RE P O RT

Principal Statements

AN N UA L FI NA NC I A L RE P O RT

Principal Statements

The Department of the Navy’s FY 2000 Principal Financial Statements and related notes are presented

in the format prescribed by the Department of Defense Financial Management Regulation 7000.14,

Volume 6B of October 2000. The statements and related notes summarize financial information for

individual funds and accounts within the Department for the fiscal year ending September 30, 2000.

The following statements are included in the Department of the Navy’s Principal Statements:

• Consolidated Balance Sheet

• Consolidated Statement of Net Cost

• Consolidated Statement of Changes in Net Position

• Combined Statement of Budgetary Resources

• Combined Statement of Financing

The Principal Statements and related notes have been prepared to report the financial position

pursuant to the requirements of the Chief Financial Officers Act of 1990, as amended by the

Government Management Reform Act of 1994.

The accompanying notes should be considered an integral part of the principal statements

Department of Defense

Navy Working Capital Fund

Consolidated Balance Sheet

As of September 30, 2000

($ in Thousands)

FY 2000

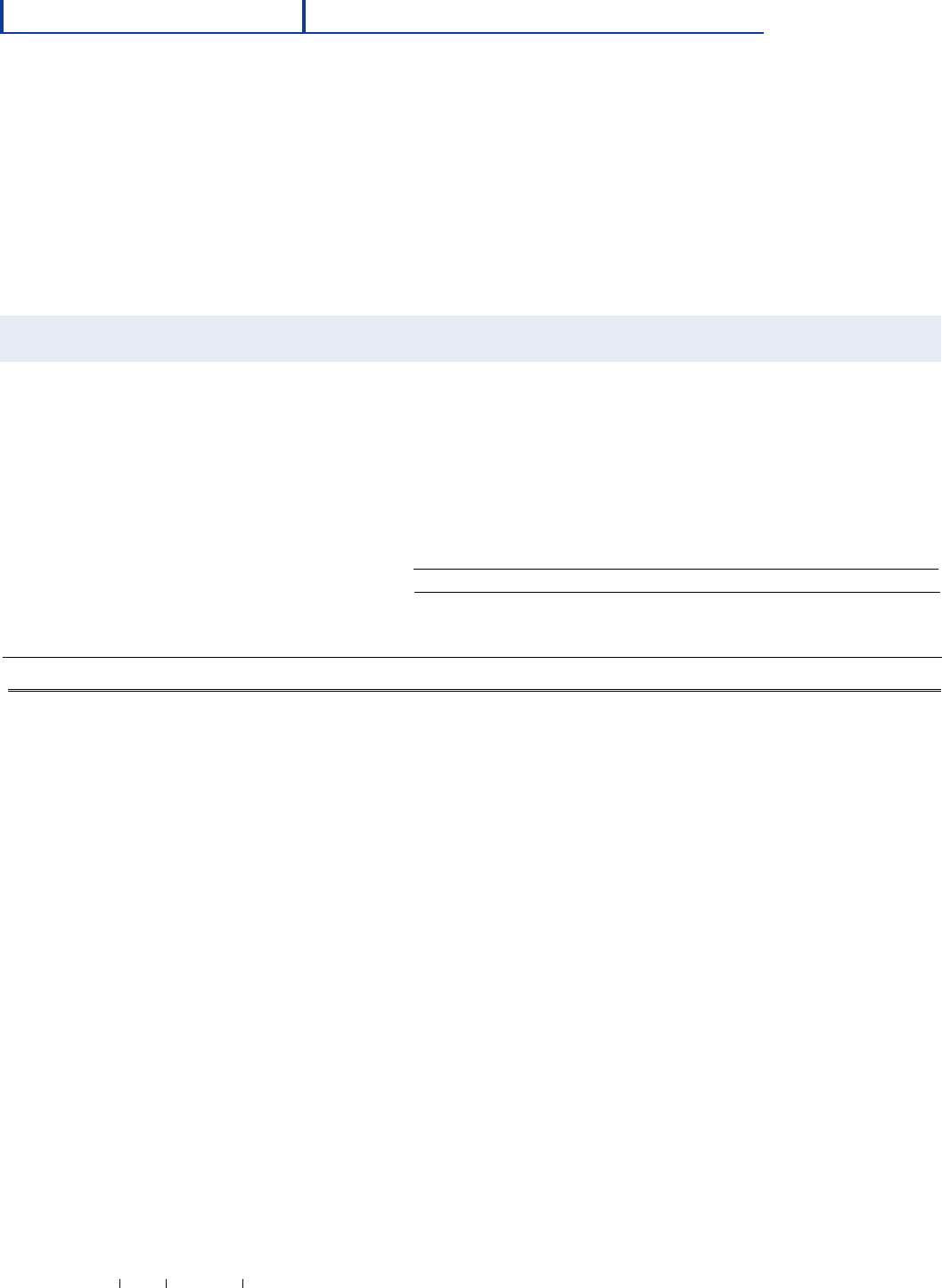

ASSETS (Note 2)

Intragovernmental:

Fund Balance with Treasury (Note 3) $ 1,473,779

Investments (Note 4) 0

Accounts Receivable (Note5) 583,425

Other Assets (Note 6) 17,657

Total Intragovernmental Assets $ 2,074,861

Cash and Other Monetary Assets (Note 7) $ 0

Accounts Receivable (Note 5) 650,124

Loans Receivable (Note 8) 0

Inventory and Related Property (Note 9) 16,870,713

General Property, Plant and Equipment (Note 10) 4,118,173

Other Assets (Note 6) 1,377,027

TOTAL ASSETS $ 25,090,898

LIABILITIES (Note 11)

Intragovernmental:

Accounts Payable (Note 12) $ 985,695

Debt (Note 13) 967,512

Environmental Liabilities (Note 14) 0

Other Liabilities (Note 15 & Note 16) 76,152

Total Intragovernmental Liabilities $ 2,029,359

Accounts Payable (Note 12) $ (1,034,979)

Military Retirement Benefits and Other Employment-Related 1,223,914

Actuarial Liabilities (Note 17)

Environmental Liabilities (Note 14) 0

Loan Guarantee Liability (Note 8) 0

Other Liabilities (Note 15 & Note 16) 3,781,870

TOTAL LIABILITIES $ 6,000,164

NET POSITION

Unexpended Appropriations (Note 18) $ 0

Cumulative Results of Operations 19,090,734

TOTAL NET POSITION $ 19,090,734

TOTAL LIABILITIES AND NET POSITION $ 25,090,898

30

FY 2000

NAV Y WO R K I NG CA P I TA L FU N D

Principal Statements

The accompanying notes are an integral part of these financial statements.

31

FY 2000

AN N UA L FI NA NC I A L RE P O RT

Principal Statements

Department of Defense

Navy Working Capital Fund

Consolidated Statement of Net Cost

Year Ended September 30, 2000

($ in Thousands)

FY 2000

Program Costs:

Intragovernmental $ 5,646,484

With the Public 7,978,806

Total Program Cost $ 13,625,290

(Less: Earned Revenue) (13,724,470)

Net Program Costs $ (99,180)

Cost Not Assigned to Programs 0