CARROLL SCHOOL OF MANAGEMENT

ACCOUNTING DEPARTMENT

Guide to Meeting

Certified Public Accountant

(CPA)

Requirements at

Boston College

Direct questions to:

Prof. Edward Taylor

Accounting Department Associate Chair

Revised: November 18, 2020

2

I. INTRODUCTION

The purpose of this guide is to assist Boston College students interested in becoming a

Certified Public Accountant (CPA). Requirements to become a CPA vary by state and may

change over time. It is therefore a prudent idea to check the Board of Accountancy’s web

site in the state you plan to practice for the latest requirements (search: ‘state’ board of

accountancy, e.g., MA state board of accountancy). An appendix of selected state CPA

web sites is provided at the end of the document.

Given the large number of BC students that end up practicing in Massachusetts and New

York, the specific CPA requirements for these states are discussed in this guide. Most

other states follow a similar set of rules but students should check with their respective

state boards to ensure that they have satisfied all the requirements. If after reading this

guide you are still uncertain as to how you will be able to meet the CPA requirements,

please consult your accounting professor or Professor Ed Taylor ([email protected]).

II. CPA REQUIREMENTS

A. General CPA Licensure Requirements. Most states impose the following

requirements to become licensed as a CPA:

(i) Be of good moral character.

(ii) Minimum age, typically 18 or 21.

(iii) Bachelor’s or baccalaureate degree (not limited to business).

(iv) 150 total credit hours including separate minimums in accounting and

business.

(v) Specific topical coverage of accounting and business courses.

(vi) Minimum work experience (i.e. one year; not needed to sit for the exam).

(vii) Pass the CPA exam.

The requirements for taking the exam may be a sub-set of the requirements for CPA

licensure, thereby allowing a candidate to take the exam even prior to satisfying all

of the CPA certification requirements. For example, in several states including

Massachusetts and New York, students need only 120 credit-hours to take the exam

but would need 150 credit-hours to become a CPA. This distinction will be

discussed in the next section.

3

B. Massachusetts (MA) CPA Requirements.

1. Exam Requirements – To apply for the CPA exam in MA, a candidate must:

be at least 18 years old;

expect to complete:

o at least 120 semester hours of course work. Under updated regulations,

students can take the CPA exam 90 days before their official graduation

date. There is still the requirement that the student provide an official

transcript proving the achievement of a bachelor’s degree with 120

credit hours minimum (including coverage in required accounting and

business subjects) within 90 days of sitting for the exam. Failure to

provide a certified transcript within the 90 day window will result in the

loss of any exam sections passed before the transcript was provided to

the Board. The Accounting Department recommends that students

eligible to take the CPA Exam in MA 90 days before graduation,

strongly consider taking one section of the exam prior to graduation.

The most common advice we hear from former students is that they

wished they finished more sections before starting work full-time. For

instance, under the new regulations, a student could study for BEC

(which BC students have historically done very well on) during the

winter break in December/January, and sit for the section in mid-to-late

February. Having one section passed before graduation will make

passing the remaining sections during the summer/fall a less stressful

discuss if this strategy may be right for you.

o a bachelor’s degree;

o at least 21 semester hours of accounting including coverage in financial

accounting, management (cost) accounting, auditing and taxation; and

o at least 9 semester hours in business including coverage in business law,

finance and information systems.

A BC undergraduate accounting major who takes all the required accounting

courses (ACCT1021, ACCT1022, ACCT3301, ACCT3302, ACCT3307,

ACCT4405) and Auditing (ACCT3309), together with the CSOM core, will satisfy

these examination requirements. Note that ACCT6618 (AIS) is no longer a

required course in MA because the information systems requirement is now

satisfied by the Computers in Management (ISYS1021) course.

4

A candidate can apply for the exam in the last semester (or summer term) he/she

expects to complete all the educational requirements by submitting a notarized

certificate of enrollment indicating the courses he/she is currently taking. The

official certificate of enrollment is downloaded from the NASBA web site

(http://www.nasba.org/files/2011/02/Cert_Enrollment_Massachusetts.pdf) --- do

not use BC’s form! In addition, the candidate must submit a final transcript within

90 days of taking the exam. Applications for the exam can be done online at the

National State Boards of Accountancy (NASBA) website:

http://www.nasba.org/exams/cpaexam/massachusetts/

Although several states now allow candidates to sit for the exam with a

reduced set of requirements, it does not mean that a student should rush to

take the exam. Historical test results show that students with a graduate

degree (150 credits compliant) pass the exam at a higher rate than students

with only an undergraduate degree.

2. CPA Certification Requirements – To be licensed as a CPA in MA, a candidate

must:

pass the CPA exam (and therefore meet all of the requirements to take the

exam);

complete at least 150 semester hours of course work. Note that under updated

regulations, community college credits earned before May 19, 2017 at

regionally-accredited institutions will be accepted to satisfy the 150 semester

hour requirement. Furthermore, there is no longer a time limit to reach the 150

credit hour requirement after passing the CPA exam;

complete one year of public accounting experience. Note: under updated

regulations, all CPA license candidates will be required to have a minimum of

one-year equivalent public accounting experience. Three years of experience in

nonpublic accounting positions (i.e. industry, government, academia, nonprofit)

is deemed equivalent to one year public accounting experience, if all of the

following three conditions are met: (1) the position is above entry level, (2)

under the supervision of a licensed CPA, and (3) responsibilities are

substantially equivalent to public accounting. Also note that the public

accounting experience requirement no longer mandates 1,000 hours of

attestation/reporting experience.

Note: under updated regulations, non-reporting licenses will no longer be

issued. An experience waiver will no longer be offered to students currently

enrolled in a graduate program.

5

meet at least one of the following educational requirements:

o earn a graduate degree in accounting from an AACSB accredited

accounting program or one that has been approved by the Massachusetts

Board of Public Accountancy (BC’s MSA program meets this

requirement); or

o earn a graduate degree in accounting, business administration (e.g.,

MBA, MSF, MST) or law from a nationally or regionally accredited

college or university. This degree must include 30 semester hours (45-

quarter hours) of accounting at the undergraduate level, or 18 semester

hours (27 quarter hours) of accounting at the graduate level. The

accounting credits shall include coverage in financial accounting,

auditing, taxation, and management accounting. In addition, the degree

must include or be supplemented by, 24 semester hours (36 quarter

hours) of business courses (other than accounting courses) at the

undergraduate level or 18 semester hours (27 quarter hours) at the

graduate level, or an equivalent combination thereof. A combination of

graduate and undergraduate credits may be used to meet the

requirements but each undergraduate credit is equivalent only to 3/5 of

a graduate credit; or

o earn at least a bachelor's degree from a nationally or regionally

accredited college or university. This degree must include or be

supplemented by 30 semester hours (45-quarter hours) of accounting

courses. The accounting credits shall include coverage in financial

accounting, auditing, taxation, and management accounting. In addition,

the degree must include, or be supplemented by, 24 semester hours (36-

quarter hours) of business courses other than accounting courses. These

business courses shall include coverage in the areas of business law,

information systems, finance, and coverage in at least one of the areas

of economics, business organizations, professional ethics, and/or

business communication.

All education credits must be completed at a nationally or regionally

accredited institution but are not limited to the candidate’s degree-granting

institution. Online courses are acceptable only if offered through a degree-

granting program at an accredited college or university.

6

C. New York (NY) CPA Requirements

1. Exam Requirements – To sit for the CPA exam in New York, a candidate must:

complete at least 120 semester hours of course work and

complete at least a course in each of the following accounting topical areas:

financial accounting, cost or management accounting, audit and attestation and

taxation. Audit cannot be taken earlier than junior year.

A BC undergraduate accounting major who takes all the required accounting

courses (ACCT1021, ACCT1022, ACCT3301, ACCT3302, ACCT3307,

ACCT4405) and Auditing (ACCT3309) will satisfy these examination

requirements.

Unlike Massachusetts, a New York state candidate must have completed 120 credit-

hours prior to applying for the exam (this can include online but not AP credits).

2. CPA Certification Requirements – To be licensed as a CPA in New York, a

candidate must:

be at least 21 years old;

be of good moral character;

pass the CPA exam;

have at least one year of full-time qualifying experience;

meet at least one of the following requirements:

o complete fifteen years of experience acceptable to the State Board for

Public Accountancy. This experience must be earned under the direct

supervision of a U.S. certified public accountant (CPA);

o obtain a bachelor’s or higher degree and complete 150 semester hours

of course work including 33 semester hours in the professional

accountancy content areas, which include but are not limited to the

following subjects: financial accounting and reporting, cost or

managerial accounting, taxation, auditing and attestation services, fraud

examination, internal controls and risk assessment, and accounting

information systems, and 36 semester hours in general business courses

including but not limited to business statistics, business law, computer

science, economics, finance, management, marketing, operations

management, organizational behavior, business strategy, quantitative

7

methods, and information technology systems. The curriculum must

also include coverage in business or accounting communications, ethics

and professional responsibility and accounting research.

Courses taken online are acceptable only if offered at a regionally

accredited college or university. Pass/fail grades are acceptable in all

subjects except accounting.

III. MEETING THE CPA REQUIREMENTS AT BOSTON COLLEGE

A. Undergraduate Degree in Accounting only – A BC undergraduate with a

concentration in accounting is required to take the following six three-credit

courses:

ACCT1021 – Introduction to Financial Accounting

ACCT1022 – Introduction to Managerial Accounting

ACCT3301 – Financial Accounting Standards & Theory I

ACCT3302 – Financial Accounting Standards & Theory II

ACCT3307 – Managerial Cost Analysis

ACCT4405 – Federal Taxation

plus one three-credit course from the following:

ACCT3309 – Auditing

ACCT3351 – Financial Statement Analysis

ACCT6601 – Financial Accounting Standards & Theory III

ACCT6618 – Accounting Information Systems

1. Qualifying for the CPA Exam Only. To meet the requirements for taking

the CPA exam in MA, a BC accounting undergraduate must take Auditing

(ACCT3309) as the elective. In addition, the student must take at least five

three-credit classes every semester including their senior year. Ignoring

Advance Placement (AP) credits, withdrawals and overloads, the student

should graduate with the minimum 120 credit-hours (5 classes/semester x 3

credits/class x 8 semesters) and satisfy the 21 Accounting and 9 general

business credit requirements to sit for the exam.

In NY, a BC accounting undergraduate needs only to take the six required

classes plus Auditing (ACCT3309) and graduate with 120 semester-credits

to qualify to sit for the CPA exam.

2. Qualifying for CPA licensure. The two key education constraints in

meeting the requirements for CPA licensure are the 150 credit hour

requirement and the minimum credit hours in Accounting. A BC

undergraduate will be unable to meet the requirements for CPA licensure

without a graduate degree unless the student obtains 30 additional credit

hours from a combination of AP credits, overloads, and summer or on-line

courses.

8

(i) The first step in determining how close a student is to meeting the 150 credit

hour requirement is to obtain a copy of the transcript or degree audit and count the

number of AP credits and courses taken. Projecting a regular five three-credit

course load throughout the four years, a BC student will graduate with a total 120

credit hours. The number of AP credits recognized (“flipped”) on the transcript

plus the total projected credit hours at graduation will determine the number of

remaining classes to be taken after graduation to meet the 150 hour requirement.

Note that while AP credits may be recognized without limit for purposes of waiving

out of core classes, Boston College requires students to have 24 or more AP credits

to be recognized for advance standing (and therefore automatically reflected on the

transcript). For students intending to take the CPA exam, however, the dean and

registrar have agreed to eliminate the minimum number of AP credits it will

recognize on the transcript. However, the recognition of this lower threshold of

AP credits can only be done after you graduate (which means it cannot be used for

advance standing but can be used for purposes of applying for the CPA). To effect

this, during the spring semester of your senior year, you must notify the

accounting department associate chair – Prof. Edward Taylor ([email protected])

of your wish to have your AP credits recognized for purposes of the CPA exam.

This list is then sent to the Office of Student Services who will “flip” (recognize)

the AP credits in your transcript as part of your total earned credits. The AP

credits are recognized on the transcript only after graduation. If you submit your

transcript before the AP credits are flipped, NASBA will not include them in

calculating your total credits. Recognition of AP credits is not automatic and is

done only if you request it from the department associate chair.

(ii) A student with 30 or more AP credits should be able to satisfy the 150 hour

requirement easily without overloads. However, the student should consult with an

accounting faculty advisor to ensure that the minimum 30 (33 in NY) accounting

credits and required course coverage are also satisfied within the four-year

program.

Students with 15-29 AP credits (or a combination of at least 15 AP and college

credits totaling 135-149) will be able to meet the 150 hour requirement by taking

no more than five classes in the summer term after their senior year.

Students with less than 15 AP credits will most probably need at least two terms (e.g.,

summer and fall) to meet the 150 hour requirement unless they overload or take on-

line classes.

9

It is important to remember that meeting the 150-hour rule is not the goal ---

obtaining the skills that would lead to a successful career is. Meeting the 150-

hour requirement but failing the CPA exam results only in wasted time and

costs. Hence, the student should avoid overloading and/or taking useless or

less rigorous courses just to meet the 150 hour requirement at the expense of

taking courses that are relevant to their careers and that would help them pass

the CPA exam.

(iii) In addition to having at least 150 total credit hours, a CPA candidate must also

take a minimum number of credits in business and accounting with specific

coverage of certain topics. In MA, CPA candidates must have at least 24 semester

hours of non-accounting business courses. In NY, CPA candidates must have at

least 36 non-accounting business courses. These requirements are met by the

management core if you do not waive out of any of them (see complete list in

Appendix A).

Students who major or minor in Arts & Sciences and elect to skip any of the

management core classes should note that business law, economics, finance,

information systems, operations management and strategy have topics covered in

the Regulation and Business Environment and Concepts sections of the CPA exam.

One should avoid electing to drop these management core classes.

(iv) In MA, the minimum number of accounting credits is 30 with specific coverage

of financial accounting, audit, taxation and management accounting. Because

accounting majors are required to take only seven accounting classes to receive the

concentration, they must take at least three additional accounting courses in order

to meet this requirement.

NY state requires 33 credits in “professional accounting” content areas, with at least

topical coverage of accounting research, ethics/professionalism and business or

accounting communication. Because an accounting concentration requires only

seven accounting classes, a student intending to practice in NY must take four

additional accounting classes. Ethics and professionalism can be satisfied by

accounting (e.g., ACCT6634) or general business courses. However, the Business

Writing & Communication (BCOM6688 or ACCT8810) and Business and

Professional Speaking classes (BCOM1116) are considered non-accounting,

business classes in all states.

The accounting research requirement is satisfied by the Federal Taxation class

(ACCT4405) and the ethics requirement is satisfied by the auditing class –

ACCT3309 in NY (refer to the table in

http://www.op.nysed.gov/prof/cpa/cpa150hour.htm). Note that Accounting

Information Systems (ACCT6618), Business Law II (BSLW1022) and FAST III

(ACCT6601) are no longer required by NY state.

10

B. Graduate Accounting Courses at Boston College – To enable students to meet

the 150 hour requirement, the Accounting department offers a large number of

graduate courses over the summer (in addition to the fall and spring semesters). At

BC, the maximum number of classes a student can take over the summer is five.

Most other institutions do not offer schedules that would allow you to take this

many classes in the summer, so plan accordingly if you intend to take the classes

elsewhere. A student who needs less than 15 credits (five classes) to reach 150 can

meet this threshold by taking classes in the summer after their senior year. Students

who need more than 15 credits (six or more classes) will need at least two terms to

reach 150.

Boston College also offers a Master of Science in Accounting program (see

www.bc.edu/msa for more details). For as few as eight courses taken over two

terms, students can satisfy the 150 hour requirement and receive an MSA degree

from Boston College. Students can complete their MSA degree over summer-fall,

fall-spring or summer-summer (if allowed by employer and with permission from

the graduate school).

BC undergraduates can also apply to the MSA program at the end of their junior

year under an accelerated admission program that waives them of having to take

the GMAT or GRE exam. To qualify for this, students must have approximately a

3.4 overall GPA and a 3.0 accounting GPA. Consult the MSA Director (Prof. Gil

Manzon) or the Graduate Programs Admissions Office if you would like more

information on the MSA program.

A student who completes the MSA degree at Boston College will automatically

satisfy all the education requirements of the MA CPA. Candidates for NY state

will also be able to satisfy their requirements but must select the right combination

of courses.

BC undergraduates who need less than eight courses and do not wish to pursue an

MSA degree to reach the 150 hours can still take classes at Boston College as

special students. However, they will need to apply to the Graduate Programs

Office as a special non-degree student before they will be allowed to register for

the classes. Application forms will be available from the Accounting department

chair starting mid-spring semester (expected due date of May 1).

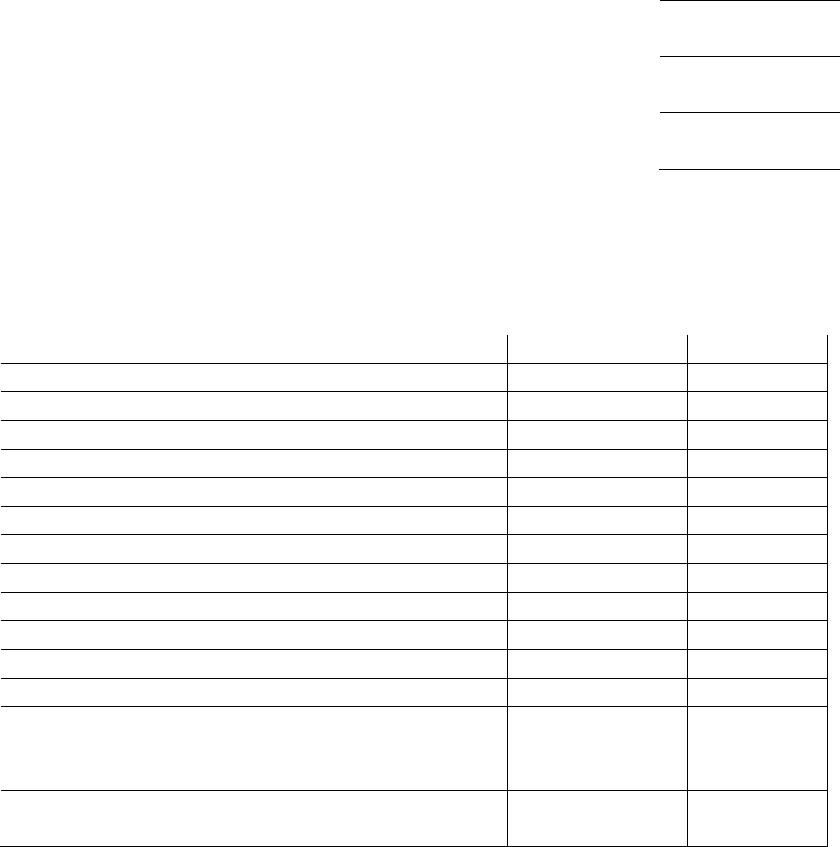

C. Planning your Courses - A checklist is provided in Appendix A to help determine

whether all education requirements are satisfied by students intending to take the

CPA exam in MA or NY. For other states, please consult the respective state boards

of accountancy (or NASBA web site: www.nasba.org) for specific course

requirements. If necessary, consult an accounting professor if you are uncertain.

11

Appendix B provides a list of all accounting courses offered at Boston College and

the term(s) when they are normally offered to help you plan your schedule. Note that

certain classes are offered only once or twice a year. Students intending to go abroad

or planning to complete the 150 in only one summer should therefore plan

accordingly.

III. INTRODUCTION TO THE CPA EXAM

A. Elements of the CPA Exam. The CPA exam is a common exam recognized by all

55 U.S. jurisdictions (50 states plus District of Columbia, Puerto Rico, Guam, U.S.

Virgin Islands and the Commonwealth of Northern Mariana Islands). While

individual states or jurisdictions may impose different education and/or experience

requirements, the CPA exam is recognized in all states regardless of where you take

it.

There are four parts to the CPA Exam. A minimum grade of 75 is required to pass

each part. A description of each part from the AICPA is provided as well as the

corresponding BC courses that cover the material follows:

1. Auditing and Attestation (AUD – 4 hours long). This section covers knowledge

of auditing procedures, generally accepted auditing standards and other standards

related to attest engagements, and the skills needed to apply that knowledge. Covered

by ACCT3309 (Audit and Assurance), ACCT4409 (Advanced Auditing) and

ACCT6618 (Accounting Information Systems). In the MSA: ACCT8815 (Financial

Auditing), ACCT6618 (Accounting Information Systems) and ACCT8825 (Assurance

& Consulting Services).

2. Business Environment and Concepts (BEC – 4 hours long). This section covers

knowledge of general business environment and business concepts that candidates

need to know in order to understand the underlying business reasons for and

accounting implications of business transactions, and the skills needed to apply that

knowledge. Covered by CSOM core, ACCT1022 (Managerial Accounting) and

ACCT3307 (Managerial Cost Analysis). In the MSA: ACCT8817 (Internal Cost

Management), MFIN7701 (Economics), MFIN7704 (Financial Management),

BZAN7720 (Operations Management).

3. Financial Accounting and Reporting (FAR – 4 hours long). This section covers

knowledge of generally accepted accounting principles for business enterprises under

US GAAP and IFRS, not-for-profit organizations, and governmental entities, and the

skills needed to apply that knowledge. Covered by ACCT3301 (FAST 1), ACCT3302

(FAST 2), ACCT6601 (FAST 3), and ACCT3351 (FSA). In the MSA: ACCT6601

(FAST III), ACCT8813 (FAP1), ACCT8814 (FAP2), and ACCT8824 (FSA).

12

4. Regulation (REG – 4 hours long). This section covers knowledge of federal

taxation, ethics, professional and legal responsibilities, and business law, and the

skills needed to apply that knowledge. Covered by BSLW1021 (Business Law I),

BSLW1022 (Business Law II), ACCT4405 (Federal Taxation), ACCT6615

(Advanced Federal Taxation), ACCT6634 (Ethics and Professionalism), and

ACCT6626 (Taxes and Management Decisions). In the MSA: BSLW8803 (Law for

CPAs) and ACCT8816 (Federal Taxation).

B. Administrative Details of the CPA Exam.

1. The exam is administered only in electronic format. To apply for the exam, go

to NASBA (www.nasba.org) and download the Candidate Bulletin for the

Uniform CPA Exam. You will also need to download all the necessary application

forms or apply electronically (in some states). Each state has its own application

process.

In MA, you can apply for the exam even prior to graduation provided you submit

your completed transcript within 90 days of taking it. If you choose to apply prior

to graduation, you need to complete a notarized Certificate of Enrollment from

NASBA that specifies the courses you are currently taking and when you expect

to graduate. You can have Sara Nunziata in the undergraduate dean’s office

(Fulton 315) or the Office of Student Services in Lyons Hall sign and notarize the

form.

New York also allows you to apply for the exam before you graduate if you have

completed 120 credit hours (excluding APs) at the time of your application.

2. Most applications will require you to submit an application form, sealed

transcript (or better yet, have BC mail the transcript directly to NASBA) and all

the necessary fees. There is a separate fee for every application and every part of

the exam you wish to take. If the application is approved, NASBA will send you

a “Notice to Schedule” (NTS) that allows you to schedule your exam at any

Prometric Office in the country (http://www.prometric.com/CPA/default.htm).

You need not take the exam in the state you intend to practice. The NTS is valid

for at least six months from the date of issue except for Texas where it is valid for

only 90 days. Check the candidate bulletin for the list of states that have a valid

period longer than 6 months.

3. Before July 1, 2020, the exam could be taken during the first two months of

any calendar quarter, defined as a “testing window”. The “testing windows” were

from January 1 to February 28 (or 29), April 1 to May 31, July 1 to August 31, and

October 1 to November 30. As of July 1, 2020, testing windows will be replaced

by continuous testing, allowing candidates to take the exam year-round, without

restriction. It can take up to 6-8 weeks to process your exam application especially

during peak periods after graduation, so make sure to allow enough time.

13

4. A candidate can schedule one, all or any combination of the four parts of the

exam at a time. However, credit for any part of the exam passed is valid for only

18 months, and the candidate must pass all the remaining parts within that period.

Otherwise, credit for that part is voided and the candidate will have to retake that

portion of the exam. In addition, there is a separate, nominal re-application fee

every time you apply to take any part of the exam.

5. Upon passing all parts of the exam, some states require that a candidate meet

the 150 hour requirement and/or work experience requirement in a certain

timeframe (note that MA no longer has this requirement). Check your specific state

board’s website for more information.

C. General Tips for Taking the Exam.

Plan your schedule in taking the exam. It can take NASBA up to 4-6 weeks to

process your first-time application to take the exam (longer during the post-

graduation period at the beginning of summer), but the reapplication period is

often much shorter. If you intend to take all four parts of the exam within a six

month period, it would be more cost-effective to apply to take all four parts of the

exam in one application, but remember that the Notice to Schedule the exam will

usually expire after six months and you lose the testing fee if you don’t take the

exam within that period.

Each testing site has a limited number of seats available to take the exam. It is a

good idea to schedule your exam as soon as possible in order to guarantee you a

seat in the testing site closest to you. Peak examination times are during week-

ends, the summer and early fall. If necessary, you can reschedule the exam (for a

fee if done within 30 days of the exam date).

Alumni overwhelmingly tell us how difficult it is to study for the exam while

working. If possible, take some or all parts of the exam soon after graduation or

while still taking graduate studies (to complete the 150 hours). One’s test-taking

skills diminish once you leave school. It is easier to take tests while your brain is

still in study-mode. As an added incentive, most accounting firms reward

employees who pass the CPA exam within one to two years of starting with a

significant cash bonus. Promotion within the firm is also often contingent on

passing the CPA exam.

It is a good idea to take a review course. Going through a review program helps

to consolidate and refresh your knowledge of material you may have studied as far

back as three years ago. Most public accounting firms will pay for your first

review course.

The CPA exam covers a wide range of topics. The minimum number of courses

required for an accounting concentration will cover most, but not all, of the areas

that will appear on the exam. Given a choice, it will only help you in the exam if

you take advantage of the many electives and graduate-level classes in accounting

that the department offers.

14

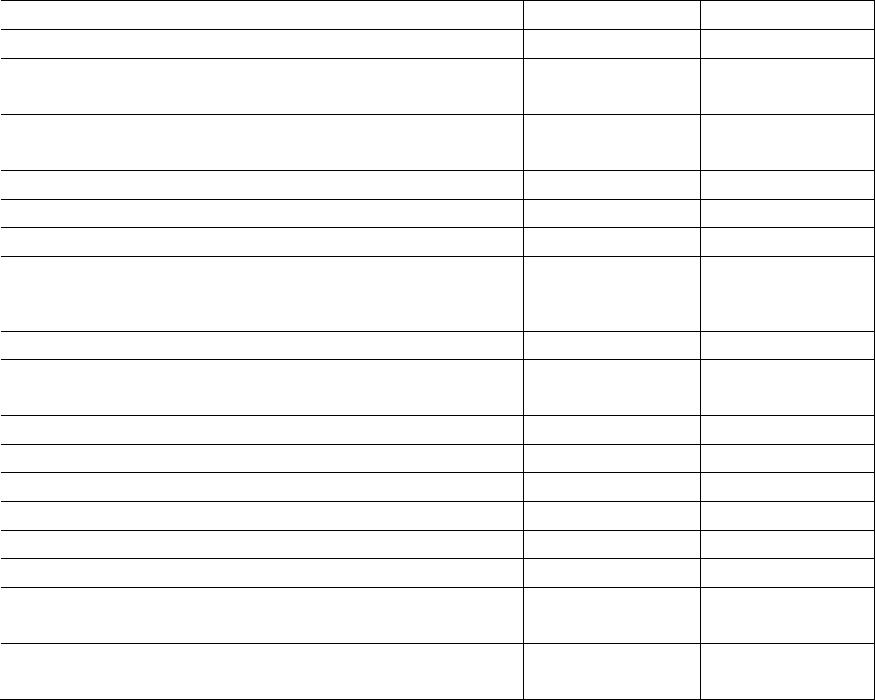

Appendix A

Checklist for determining CPA Certification as an Undergraduate

Step 1: Count the total number of credits expected at graduation.

Total number of AP credits

Total number of credits earned to date

Total number of credits expected to earn in remaining semesters

Total expected credits at graduation

REQUIRED IN MOST STATES: 150 total credit hours satisfied?

Step 2: Count the total number of credits in non-accounting business classes.

Management core (3 credits each)

Semester taken

# of credits

1) Principles of Economics I (ECON1131)

2) Principles of Economics II (ECON1132)

3) Statistics (ECON1151)

4) Computers in Management (ISYS1021)

5) Organizational Behavior (MGMT1021)

6) Fundamentals of Finance (MFIN1021)

7) Principles of Marketing (MKTG1021)

8) Introduction to Law (BSLW1021)

9) Operations Management (BZAN1021)

10) Strategic Management (MGMT3099)

11) Portico (PRTO1000)

12) Modeling for Business Analytics (BZAN2235)

13) Business Writing (BCOM6688) or Business &

Professional Speaking (BCOM1116) –

required in NY

TOTAL

MA requirement is 24 credits (8 classes) satisfied with the management core.

NY requirement is 36 credits (12 classes) satisfied with the management core.

15

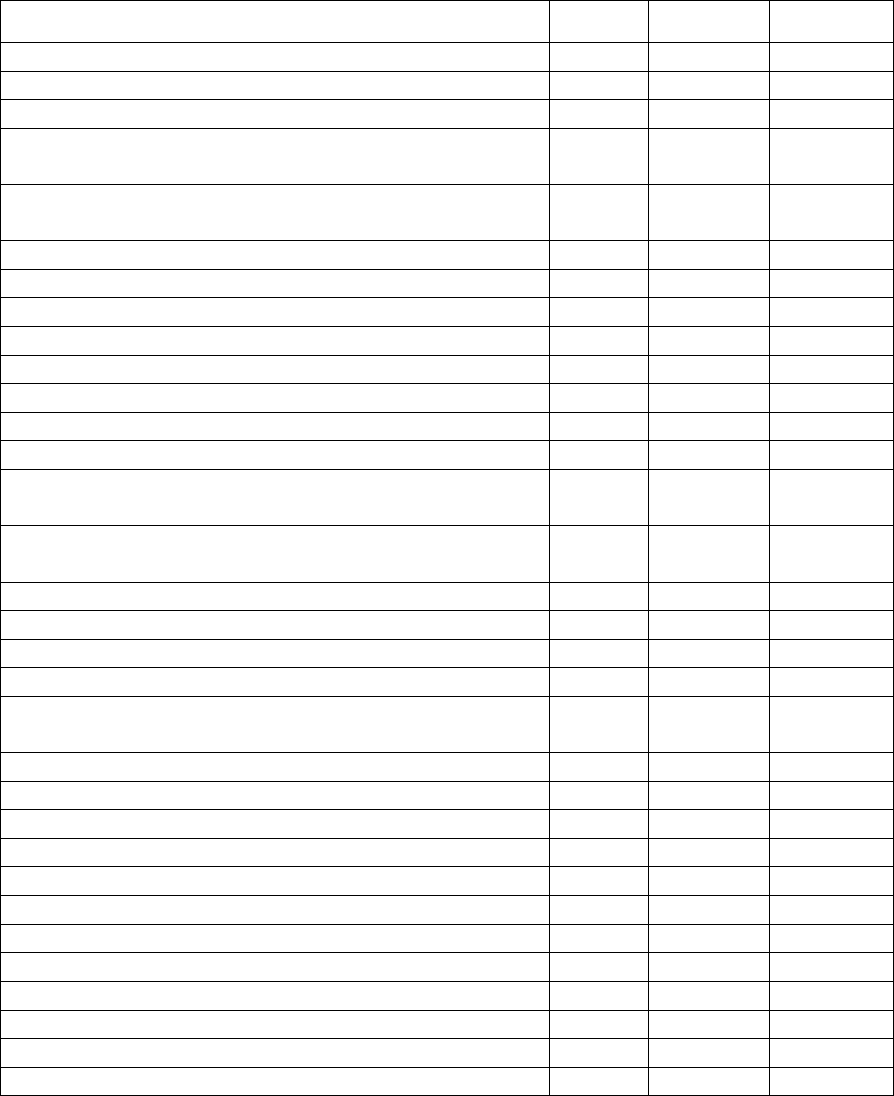

Step 3: Count the total number of credits in Accounting courses.

Accounting (3 credits each)

Semester taken

# of credits

1) ACCT1021 – Financial Accounting

2) ACCT1022 – Managerial Accounting

3) ACCT3301 – Financial Accounting Standards &

Theory I (FAST I)

4) ACCT3302 – Financial Accounting Standards &

Theory II (FAST II)

5) ACCT3307 – Managerial Cost Analysis

6) ACCT3309 – Auditing

7) ACCT4405 – Federal Taxation

Others:

8) ACCT3351 – Financial Statement Analysis

9) ACCT4409 – Advanced Auditing

10) ACCT6601 – Financial Accounting Standards &

Theory III (FAST III)

11) ACCT6615 – Advanced Federal Taxation

12) ACCT6618 – Accounting Information Systems

13) ACCT6623 – Fair Value Accounting

14) ACCT6626 – Taxes & Management Decisions

15) ACCT6634 - Ethics & Professionalism *

16) ACCT6635 – Forensic Accounting

17) ACCT6640- Dive, Dissect & Decide with

Big Business Data

TOTAL

*Massachusetts is no longer accepting this course as one of the required 10 accounting classes. Please check with

the state where you plan to practice to see if this course will count towards your required Accounting credits.

MA requires 30 Accounting credits (equivalent to 10 Accounting classes)

NY requires 33 Accounting credits (equivalent to 11 Accounting classes)

but also requires a Business Communications course, such as Business

Writing (BCOM6688) or Business & Professional Speaking (BCOM1116).

Business communication classes do not count as accounting.

16

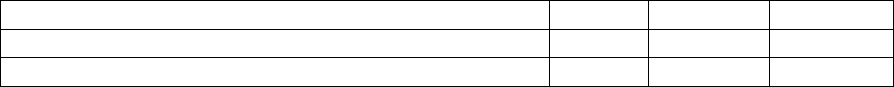

Appendix B

Accounting & Other CPA Required Course Offerings

By Term

Fall

Spring

Summer

Undergraduate:

ACCT1021 – Financial Accounting

√

√

ACCT1022 – Managerial Accounting

√

√

ACCT3301 – Financial Accounting Standards &

Theory I (FAST I)

√

√

ACCT3302 – Financial Accounting Standards &

Theory II (FAST II)

√

√

ACCT3307 – Managerial Cost Analysis

√

√

ACCT3309 – Auditing

√

√

ACCT3351 – Financial Statement Analysis

√

√

ACCT4405 – Federal Taxation

√

√

ACCT4409 – Advanced Auditing

√

BCOM1116 – Business & Professional Speaking*

√

√

BCOM6688 – Business Writing & Communication *

√

√

Upper-level (can be taken by Undergraduate or

Graduate):

ACCT6601 – Financial Accounting Standards &

Theory III (FAST III)

√

√

√

ACCT6615 – Advanced Federal Taxation

√

√

ACCT6618 – Accounting Information Systems

√

√

√

ACCT6623 – Fair Value Accounting

√

√

ACCT6626 – Taxes & Management Decisions

√

√

ACCT6634 – Ethics & Professionalism in

Accounting ^

√

√

ACCT6635 – Forensic Accounting

√

√

ACCT6640 – Dive, Dissect & Decide w/BBD

√

Graduate:

ACCT8810 – Communication Skills for Managers**

√

ACCT8813 – Financial Accounting Practice I

√

√

√

ACCT8814 – Financial Accounting Practice II

√

√

ACCT8815 – Financial Auditing

√

√

ACCT8816 – Federal Taxation

√

√

ACCT8817 – Internal Cost Management and Control

√

√

ACCT8824 – Financial Statement Analysis

√

√

√

ACCT8825 – Assurance and Consulting Services

√

√

17

Non-Accounting Courses:

BSLW1022 – Business Law II

√

√

BSLW8803 – Law for CPAs

√

√

√

^Massachusetts is no longer accepting this course as one of the required 10 accounting classes. Please check with

the state where you plan to practice to see if this course will count towards your required Accounting credits.

* Will not be recognized as an accounting course but will count as a business course in

all states.

** May not be recognized as an accounting course but will count, at a minimum, as a

business course in all states.

18

Appendix C

Useful CPA Websites

www.nasba.org – National State Boards of Accountancy (NASBA) website for state-

specific exam requirements and application forms.

www.mscpaonline.org – Massachusetts State Society of CPAs website for information

on Massachusetts CPA requirements. Also useful source of information for

scholarships and CPA events.

http://www.op.nysed.gov/prof/cpa/cpalic.htm – New York state education department

website for information on New York state CPA requirements.

Other state-specific websites on becoming a CPA:

CA: http://www.calcpa.org/Content/licensure/requirements.aspx

CT: http://www.cscpa.org/Content/22974.aspx

IL: http://www.icpas.org/hc-students.aspx?id=2730

MA: http://www.cpatrack.com/becoming_a_cpa/

MD: http://www.macpa.org/Content/16157.aspx

MN: http://www.mncpa.org/career/becoming_a_cpa/

NH: http://www.nh.gov/accountancy/certification/index.htm

NJ: http://www.state.nj.us/lps/ca/accountancy/index.htm

NY: http://www.nysscpa.org/society/Future_CPAs/howtobecomeanaccountant.htm

PA: http://www.picpa.org/Content/38481.aspx

RI: http://www.dbr.state.ri.us/divisions/accountancy/

TX: http://www.tsbpa.state.tx.us/

19

FAQs

Can I still go abroad and will the credits taken overseas count?

Yes, courses taken through an international program offered by the Office of

International Programs at BC are recognized on the BC transcript and will count

towards meeting the 150 hour rule. However, there are a limited number of accounting

classes that are recognized by the department because of differences in accounting

standards (this constraint may disappear in time). As such, careful planning of courses

is critical in order to meet the minimum Accounting credits required, especially if the

student intends to meet the CPA requirements within a four-year undergraduate

program. In addition, students should make sure to take at least fifteen credits per

semester abroad in order to stay on track with meeting the required 150 hours.

Can I still double-major if I want to meet the CPA requirements?

The department encourages students to take courses other than Accounting to expand

their understanding of how businesses operate. Having a second concentration can

also make you more attractive to potential employers. However, double-majoring and

meeting the accounting and 150-hour requirements within a four-year program will be

extremely difficult in the absence of significant AP credits. On the other hand,

completing a double-major with an MSA degree is very feasible. Make sure to consult

with an accounting faculty advisor as soon as possible if you plan to double-

concentrate.

Must I take all my classes at BC or can I take some of the classes elsewhere?

You do not need to have all your credits come from the same institution. If the credits

are earned at multiple institutions, you will need to submit transcripts from all

institutions when you apply for the CPA exam. Only credits earned at institutions that

are accredited or recognized by the institution’s state are acceptable.

Can I take on-line courses to satisfy the 150-hour requirement?

Most states, including MA and NY, will accept on-line classes provided they are offered

by a regionally or nationally accredited institution or are accepted for transfer to a

regionally or nationally accredited institution. On-line credits are not recognized by

BC and separate submission of their transcripts will be required in your CPA

application.

20

Can I take summer classes elsewhere to satisfy the 150-hour requirement?

Yes, summer classes are acceptable provided they are offered by a regionally or

nationally accredited institution or an institution recognized by the state board of

accountancy. However, unless the courses are taken at BC, they will not be recognized

on the BC transcript and separate submission of the transcript will be required when

you apply for the CPA exam.

What elective courses would you recommend to someone preparing for the

CPA exam?

There are certain topics on the exam that are not covered in the required classes to

concentrate in accounting. For this reason, the department recommends that students

intending to sit for the CPA exam should also take Advanced Auditing (ACCT4409),

FAST III (Advanced Accounting ACCT6601), Advanced Federal Taxation

(ACCT6615), Ethics and Professionalism (ACCT6634), and Commercial Law (covered

in Business Law II – BSLW1022 or Law for CPAs BSLW8803).

Should I skip any management core classes if I also major or minor in Arts

& Sciences (class of 2016 onwards only)?

You should be aware that certain parts of the CPA exam, such as BEC and REG, cover

topics in non-accounting business classes such as business law, economics, finance,

information systems, operations management and strategy. You should therefore avoid

dropping these core classes. In addition, certain states require a minimum number of

non-accounting business credits for CPA certification.

Still confused? Attend the department’s “How to Meet the 150 Hour Requirement”

and “Preparing for the CPA Exam” panels hosted every semester, or consult your

accounting professor, accounting department associate chair, or the accounting

department administrator in Fulton 520.